Search Results

Search results for: "Creditas" in All Categories

-

25 January 2022

Fidelity Management Leads USD260m Series F for Brazilian Fintech Creditas

Fidelity Management led a USD260m Series F for Brazilian fintech Creditas...

-

24 May 2021

Creditas Leads BRL95m Round for Brazilian Electric Motorcycle Company Voltz

Creditas led a BRL95m round for Voltz, a Brazilian electric motorcycle...

-

3 February 2021

IDB Invest Provides US$30m in Debt Financing to Brazilian Fintech Creditas

IDB Invest provided US$30m in debt financing to Brazilian fintech...

-

17 December 2020

LGT Lightstone Leads US$255m Series E in Brazilian Fintech Creditas

Impact investment fund LGT Lightstone led a US$255m Series E in Brazilian...

-

1 August 2019

Creditas Acquires Creditoo (em português)

Brazilian fintech Creditas acquired Creditoo, a credit consignment...

-

6 June 2019

Crunchbase: SoftBank Invests In Brazil’s Loggi, A New Unicorn, And Creditas

-

4 June 2019

Softbank Invests US$231m in Creditas

SoftBank led a US$231m investment in Brazilian fintech Creditas at a...

-

4 April 2019

Seu Dinheiro: Fundo japonês deve escolher Creditas e Grow

-

18 April 2018

Vostok Emerging Finance Contributes Additional US$5m to Series C in Brazilian Digital Lending Platform Creditas

Vostok Emerging Finance led a US$55m Series C investment in Creditas, with...

-

12 December 2017

Vostok Emerging Finance Leads US$50m Investment in Creditas

Vostok Emerging Finance led a US$50m investment in Creditas (formerly...

-

20 February 2017

IFC Leads R$60m Series B in Creditas (formerly BankFacil) (em português)

The International Finance Corporation (IFC) led a R$60m Series B...

-

4 February 2017

Creditas, Contabilizei, Descomplica and Satellogic Among LatAm's Top 10 Most Innovative Companies

Venture capital backed startups Creditas, Descomplica, Contabilizei, and...

-

16 February 2023

2023 LAVCA Trends in Tech

Access LAVCA’s 2023 LAVCA Trends in Tech, which breaks down 2022 VC...

-

25 October 2021

Brazilian Car Insurtech Justos Raises ~USD35.8m Series A from SoftBank, KASZEK and Others

Justos, a Brazilian pre-launch car insurance platform, raised a ~USD35.8m...

-

5 October 2021

Mercado Libre and KASZEK SPAC Raises USD287m In Public Listing

MELI Kaszek Pioneer Corp (MEKA), a SPAC formed by Mercado Libre and...

-

13 September 2021

Kinea Ventures Leads ~USD5.4m Series A for Brazilian Credit Consignment Platform Paketá (em português)

Kinea Ventures, the CVC arm of Itaú, led a ~USD5.4m Series A for Paketá,...

-

1 September 2021

2021 Latin American Startup Directory

Venture investment has grown dramatically in Latin America since 2016 to...

-

1 September 2021

KASZEK and monashees Lead ~USD9m Seed Round for Brazilian Lending Platform TruePay (em português)

KASZEK and monashees led a ~USD9m seed round for TruePay, a Brazilian...

-

30 August 2021

ALLVP and Vine Ventures Lead USD6m Round for Mexican Proptech Kocomo

ALLVP and Vine Ventures led a USD6m round for Kocomo, a Mexican vacation...

-

16 August 2021

Alexia Ventures Leads ~USD3.4m Round for Brazilian Edtech HeroSpark (em português)

Alexia Ventures led a ~USD3.4m round for HeroSpark, a Brazilian education...

-

3 August 2021

General Atlantic and SoftBank Lead ~USD125m Round for Brazilian Digital Protection Platform unico

General Atlantic and SoftBank led a ~USD125m round for unico, a...

-

3 August 2021

General Atlantic and SoftBank Lead ~USD125m Round for Brazilian Digital Protection Platform unico

General Altantic and SoftBank led a ~USD125m round for unico, a Brazilian...

-

12 July 2021

DOMO Invests ~1USDm in Brazilian Car Resale Marketplace Usadosbr (em português)

DOMO invested ~USD1m in Usadosbr, a Brazilian car resale marketplace. ...

-

7 July 2021

Lightrock Reaches USD900m Final Close for Global Growth Fund

Lightrock reached a USD900m final close for its Lightrock Growth Fund I....

-

18 June 2021

QED Investors Leads USD30m Series B for Brazilian Solar Energy Financing Platform Solfácil

QED Investors led a USD30m Series B for Solfácil, a Brazilian solar...

-

10 June 2021

Lightrock Leads BRL700m Series C for Brazilian Bus Ticketing Platform Buser

Lightrock led a BRL700m (~USD138.6m) Series C for Buser, a Brazil-based...

-

20 April 2021

QED Investors Leads UDD15m Series B for Brazilian Payment Services Provider Hash

QED Investors led a USD15m Series B for Hash, a Brazilian payment services...

-

10 March 2021

Canary Leads BRL3.6m Round for Brazilian On-Demand Sales Talent Platform Cloud Humans (em português)

Canary led a BRL3.6m round for Cloud Humans, a Brazilian on-demand...

-

27 January 2021

QED Investors Leads US$6m Round in Lending Platform Milo

QED Investors led a US$6m round in Milo, a Colombia- and Miami-based...

-

15 January 2021

KaszeK Ventures Leads R$20m Series A in Brazilian Customer Service Platform OmniChat

KaszeK Ventures led a R$20m Series A in OmniChat, a Brazilian chat-based...

-

14 January 2021

SoftBank Latin America Leads Series C Investment in Brazilian Fiscal and Accounting System Contabilizei

SoftBank Latin America led an undisclosed Series C in Contabilizei, a...

-

10 December 2020

KaszeK Ventures and QED Investors Lead US$62m Series B in Bitso

KaszeK Ventures and QED Investors led a US$62m Series B in Bitso, a...

-

8 December 2020

Volpe Capital Reaches US$50m First Close for Early Stage Latin America Fund (em português)

Volpe Capital, a VC fund founded by former SoftBank Managing Partner Andre...

-

21 September 2020

General Atlantic and SoftBank Lead US$108m Series B in Acesso Digital

General Atlantic and SoftBank’s Latin America Fund led a US$108m Series...

-

5 September 2020

Redpoint eventures Leads R$10m Series A in Brazilian Clothing Resale Marketplace Repassa (em português)

Redpoint eventures led a R$10m Series A in Repassa, a Brazilian clothing...

-

29 July 2020

Redpoint eventures Leads US$11m Series B in Magnetis

Redpoint eventures led a US$11m Series B in Magnetis, a Brazilian personal...

-

11 July 2020

QED Investors, KaszeK Ventures, and Others Invest US$22.5m Series B in Digital Brokerage Warren

QED Investors led a US$22.5m Series B in Brazilian digital brokerage...

-

17 June 2020

Redpoint eventures Leads a US$2.3m Round in Customer Intelligence Platform Arena

Redpoint eventures led a US$2.3m seed round in San Francisco-based Arena,...

-

3 June 2020

Valor Capital and Redpoint eventures Lead a US$47m Series B in Tembici

Tembici, a Brazilian micro-mobility platform focused on bikes, raised a...

-

1 June 2020

SoftBank Latin America Fund Leads a US$22m Series B in Cortex

Cortex, a Brazilian SaaS marketing and sales growth platform, raised a...

-

22 May 2020

Quona Capital Leads a US$15m Round in Colombian Lending Platform ADDI

Quona Capital led a US$15m round in ADDI, a Colombian point-of-sale...

-

4 March 2020

Quona Capital Closes its Accion Quona Inclusion Fund with US$203m in Commitments

Quona Capital closed its second fund with US$203m in commitments. The...

-

27 February 2020

QED Investors Closes Its Sixth Fund with US$350m in Commitments

QED Investors closed its sixth fund with US$350m in commitments....

-

20 February 2020

Redpoint Eventures and DNA Capital Invest US$4.5m in Memed

Redpoint eventures and DNA Capital, the corporate venture arm of DASA, led...

-

7 February 2020

Redpoint Eventures Invests US$4m in Kzas

Redpoint eventures led a US$4m seed investment in Kzas, a Brazilian...

-

29 January 2020

Monashees Leads a R$20m Seed Investment in Yuca (em português)

In 2019, monashees led a R$20m seed investment in Yuca, a Brazilian rental...

-

13 December 2019

Ânimo Wellness Raises a US$300k Round

Brazilian healthtech Ânimo Wellness raised a US$300k pre-seed round from...

-

29 November 2019

Redpoint eventures Invests R$50m in Housi (em português)

Redpoint eventures made a R$50m investment in Housi, a Brazilian property...

-

22 November 2019

SoftBank Leads a US$140m Investment in VTEX

SoftBank led a US$140m investment in VTEX, a Brazilian ecommerce SaaS...

-

17 October 2019

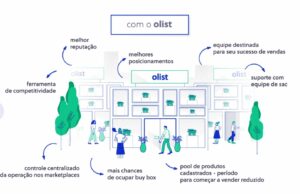

SoftBank Leads a R$190m Investment in Olist (em português)

SoftBank led a R$190m investment in Olist, a Brazilian e-commerce...

-

17 September 2019

Vostok Emerging Finance Leads a US$13m Investment in Xerpa (em português)

Vostok Emerging Finance led a US$13m investment in Xerpa, a Brazilian...

-

2 September 2019

IFC Leads a R$70m Investment in Revelo (em português)

The IFC led a R$70m investment in Revelo, a Brazil-based job matching...

-

29 August 2019

KaszeK Ventures Raises US$600m Across Two New Funds

KaszeK Ventures raised US$600m across two new funds, including US$375m for...

-

15 February 2019

Five Elms Capital Invests US$7m in PlayVox

Five Elms Capital made a US$7m investment in PlayVox, an omnichannel...

-

28 November 2018

Global Founders Capital Leads US$1.2m Investment in Online Payroll Loan Platform Creditoo (em português)

Global Founders Capital led a US$1.2m investment in Creditoo, an online...

-

13 April 2018

Monashees+ and Vostok Emerging Finance Lead R$17m Series A in Brazil's Magnetis Investments (em português)

monashees+ and Vostok Emerging Finance led a R$17m Series A investment in...

-

6 April 2018

Vostok Emerging Finance Leads R$12m Series A in Brazil's FinanZero

Vostok Emerging Finance led a R$12m investment in FinanZero, a Brazilian...

-

24 January 2018

Chromo Invest & 42K Investimentos Invest R$15m in Brazil's BizCapital (em português)

Chromo Invest and 42K Investments made a R$15m investment in BizCapital, a...

-

11 January 2018

State of the Industry: 2017 VC Deal Activity & Highlights

The entrance of major global investors into a string of recent early and...

-

10 January 2018

IFC Invests R$15m in Brazilian Fintech Startup Koin (em português)

The International Finance Corporation (IFC) led a R$15m investment in...