Deal Case Highlight Canary | Alicerce Educação: A Bridge to Education

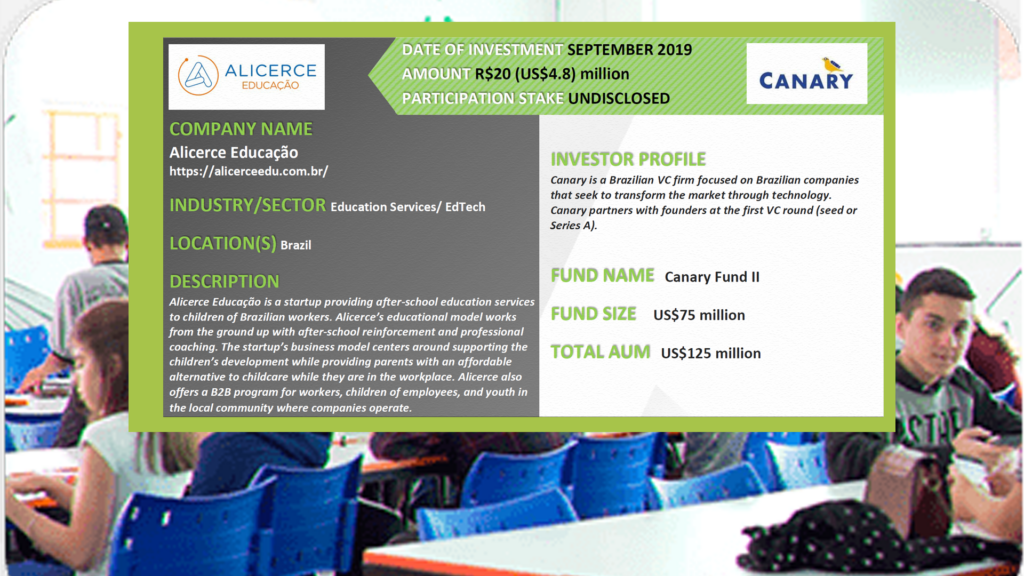

Member Investor: Canary

Company: Alicerce Educação

Industry-Sector: Education Services/ EdTech

According to the OECD, Brazil’s federal government invests an average of US$3,700 per student in early childhood education, compared to US$7,800 for all OECD countries. In the 2018 OECD Program for International Student Assessment Survey (PISA), 43% of Brazilian students scored below the minimum level of proficiency in reading, mathematics, and science. Mean performance in the survey was linked to socio-economic status, as advantaged students outperformed disadvantaged students across all three areas of proficiency. In a country where over 80% of students attend public schools, achieving adequate levels of proficiency for disadvantaged students remains a challenge.

OPPORTUNITY

In the Brazilian educational system, public school schedules are often structured as five-hour sessions. Depending on the school size and number of students, a school may offer two or three sessions per day (e.g., 7 a.m. – noon, noon – 5 p.m., or 5 p.m. to 10 p.m.), and students may only attend one. Given that these sessions do not coincide with typical working hours, parents often have to pay for additional childcare services while they are at work.

Alicerce was created by Paulo Batista, former CEO of dental supplies distributor Dental Cramer, to fill the gap left by public schooling in Brazilian children while also providing low- and middle-income families with an affordable and more productive alternative to traditional childcare. Alicerce offers a contraturno, or afterschool, educational program while children are not at school. Students spend five hours per day in one of Alicerce’s learning centers, where each student follows a tailored learning plan centered around Portuguese, math, English, programming, and socioemotional development.

Before Canary’s initial investment, Alicerce had 40 physical learning centers and needed additional capital to support the company’s rapid national expansion. In September 2019, Canary co-led a R$20m (US$4.8m) seed round alongside Valor Capital Group, with participation from angel investors Arminio Fraga, David Feffer, Luiz Fernando Figueiredo, Wolff Klabin, and Daniel Goldberg.

EXECUTION DURING COVID-19

Following its seed round, Alicerce embarked on an ambitious plan to launch 15 new learning centers per month. As the COVID-19 pandemic evolved and social distancing guidelines were put in place, schools and learning centers had to cease on-site operations and rethink longstanding approaches to education. Alicerce was no exception as the startup halted the opening of new learning centers and shifted efforts towards improving its online learning services and completing 46 centers that were already in development.

With Canary’s support, Alicerce launched ALIQUEST in early 2020, a proprietary Learning Management System (LMS), to provide online educational services at-scale. Since the launch of ALIQUEST, Alicerce increased its student base to more than six thousand in all 27 Brazilian states.

In addition, the company also introduced a B2B program through which companies can hire Alicerce to offer educational programs to workers, children of employees, or youth in the local community where the companies operate. This initiative has gained traction and turned into one of the main revenue drivers for the company: in Q1 2020, Alicerce had one thousand students participating in its B2B program, representing R$150 thousand in recurring revenue; in Q4 2020, the program had 11 thousand students and R$1.6 million in recurring revenue. Despite the pandemic, Alicerce’s sales grew from R$297 thousand in 2019 to R$2 million in 2020, buoyed by the company’s pivot towards online and B2B services.

COMMUNITY IMPACT AND SENIOR LEADERSHIP

Alicerce’s approach to education has shown that students can review the equivalent of 1.2 years of public schooling every 60 days. The company serves as a bridge for children of low- and middle-income families to fill the gaps left by a deficient public schooling system. Families served by Alicerce often include one-parent households and afrodescendentes.

In terms of diversity and gender inclusion, Alicerce Educação’s Executive Committee is composed of eight senior directors, including two women and one member of the LGBTQ+ community. Alicerce’s Diversity Committee is chaired by Andrea Matsusi, and the educational program was co-created by Head of Learning Dr. Monica Weinstein and CEO Paulo Batista… download the full case study to read more.

You may be interested in...

-

Lightrock | dr.consulta

In December 2017, Lightrock invested in dr.consulta, a Brazil-based clinic chain that...

-

Elevar Equity | TICMAS

In June 2018, Elevar Equity invested in TICMAS, an education platform with operations in...

-

Vinci Partners | Pro Infusion

In November 2020, Vinci Partners invested in Pro Infusion, a Brazil-based outsourcing...

-

L Catterton | NotCo

In August 2020, L Catterton invested in NotCo, a Chile-based foodtech company that...