Search Results

Search results for: "stori" in All Categories

-

31 May 2023

Community Investment Management Provides USD50m Credit Line to Mexico’s Stori

Community Investment Management provided a USD50m credit line to Stori,...

-

25 February 2021

Lightspeed Ventures Leads USD32.5m Series B for Mexican Credit Card Issuer Stori

Lightspeed Ventures led a USD32.5m Series B for Stori, a Mexican credit...

-

16 September 2020

DOMO Invest Leads R$5.5m in Brazilian Proptech Rede Vistorias (em português)

DOMO Invest led a R$5.5m round in Rede Vistorias, a Brazilian proptech...

-

9 July 2020

El Economista: La CNV autorizó la salida a oferta pública de CITES I, un hito en la historia del organismo

-

5 February 2020

Bertelsmann Investments and Source Code Capital Lead a US$10m Series A in Stori

Bertelsmann Investments and Source Code Capital led a US$10m Series A in...

-

7 May 2018

FIR Capital and Bzplan Make R$2m Investment in Brazilian Real Estate Platform Rede Vistorias (em português)

FIR Capital and Bzplan made a R$2m investment in Rede Vistorias, a...

-

21 March 2012

PE/VC Firms Raise Historic Record of $10.3 Bln for Latin America in 2011

-

14 September 2011

Latin America Fundraising on Track to Break Historical Record, Exits Surge

-

22 August 2023

2023 Startup Directory & Ecosystem Insights

LAVCA’s 2023 Startup Directory & Ecosystem Insights profiles 501...

-

16 February 2023

2023 LAVCA Trends in Tech

Access LAVCA’s 2023 LAVCA Trends in Tech, which breaks down 2022 VC...

-

17 August 2022

2022 Latin American Startup Directory

LAVCA’s seventh annual Latin American Startup Directory profiles 523...

-

31 July 2022

Argo Energia Acquires Quantum Assets from Brookfield for BRL4.3b

(Brazil Journal) Colombia-controlled energy transmission company Argo...

-

14 June 2022

BNDES To Invest BRL2.5b in Funds Managed by Vinci, BTG Pactual, Kinea and Patria

BNDES will invest a combined BRL2.5b in Brazil-based infrastructure funds...

-

30 May 2022

Alloy Capital Invests Debt in Mexico’s MAS Seguros

Alloy Capital provided structured debt to Mexico-based risk management...

-

25 April 2022

IG4 Capital To Raise USD500m Fund III and USD300m Credit Fund

IG4 Capital is planning to raise a new USD300m credit fund providing...

-

19 April 2022

BNDES invests BRL250m in Lightrock's Growth Equity Fund II Brasil

BNDES agreed to invest up to BRL250m in Lightrock’s Growth Equity Fund...

-

7 April 2022

Lanx Capital, Gávea Investimentos, Dynamo and the Moreira Salles FO Invest BRL389m in Brazil’s re.green

The family office of the Moreira Salles family, Lanx Capital, Gávea...

-

7 March 2022

Vinci Partners Leads BRL650m Investment in Brazil’s Evino

Vinci Partners, through its Vinci Capital Partners III, led a BRL650m...

-

13 February 2022

First Rock Private Equity Acquires Majority Stake in Trinidadian Petroleum Company

First Rock Private Equity agreed to acquire an 85% stake in a petroleum...

-

7 February 2022

2022 LAVCA Trends in Tech

Access LAVCA’s 2022 LAVCA Trends in Tech, which breaks down 2021 VC...

-

3 February 2022

Kinea Ventures and G2D Lead USD25m Series A for Brazilian E-Commerce Platform Digibee (em português)

Kinea Ventures and Brazil VC G2D led a USD25m Series A for Digibee, a...

-

26 January 2022

Founders Fund Leads USD6m Seed Round for Retail Trading Platform Vest

Founders Fund led a USD6m seed round for Vest, a retail platform enabling...

-

14 December 2021

Axxon Partners Invests BRL100m+ in Brazil’s JA Saúde Animal

Axxon Partners invested over BRL100m for a minority stake in JA Saúde...

-

28 October 2021

Astella Investimentos Leads ~USD5m Round for Brazilian Proptech Homelend (em português)

Astella Investimentos led a ~USD5m round for Homelend, a Brazilian real...

-

18 October 2021

SP Ventures and Astella Investimentos Lead USD17m Series A for Brazilian Fintech Traive (em português)

SP Ventures and Astella Investimentos led a USD17m Series A for Traive, a...

-

29 September 2021

500 Global, Dalus Capital and IDB Lab Invest USD10m in Colombian Budget Chain Ayenda (en español)

Ayenda, a Colombian budget hotel chain, raised a USD10m round from 500...

-

31 August 2021

GIC and Carlyle Partially Exit Brazil’s Rede D'Or for BRL2.6b (em português)

GIC and the Carlyle Group sold 37 million shares of Brazil-based hospital...

-

30 August 2021

Financial Advisor Platform Origin Raises USD57m Series B from 01A, General Catalyst and Lachy Groom

Origin, a US-based financial advisor platform for company employees with...

-

6 August 2021

Brookfield Acquires Aldo Solar

Brookfield acquired Aldo Solar, a distributor of solar home generators in...

-

5 August 2021

IG4 Capital Acquires ~34% Stake in Peruvian Infrastructure Platform Aenza

IG4 Capital, through IG4 Private Equity Fund II and managed accounts,...

-

3 August 2021

SoftBank Leads ~USD116m Series C for Brazilian ERP Omie

SoftBank led a ~USD116m Series C for Omie, a Bazilian ERP for SMEs, with...

-

2 August 2021

Prosus Invests USD194m in Brazil’s Movile

Prosus Ventures invested USD200m in follow-on financing in Brazil-based...

-

26 July 2021

Stonepeak to Acquire Lumen's Latin American Business for USD2.7b

Stonepeak agreed to acquire the Latin American operations of Lumen...

-

14 July 2021

Imaginable Futures Leads ~USD3.1m Round for Brazilian Edtech Arvore (em português)

Imaginable Futures led a ~USD3.1m round for Árvore, a Brazilian digital...

-

2 July 2021

Canary Leads USD1.4m Round for Brazilian Subscription Management Platform Lastlink (em português)

Canary led a USD1.4m round for Lastlink, a Brazilian community and...

-

1 July 2021

SoftBank Invests USD200m in Brazilian Bitcoin Exchange Mercado Bitcoin (en español)

SoftBank invested USD200m in Brazilian bitcoin exchange Mercado Bitcoin,...

-

29 June 2021

IDB Invest, Blue Like an Orange and Mexico Ventures Lead USD27.5m Round in Mexican Lending Platform kubo.financiero (en español)

IDB Invest, Blue Like an Orange and Mexico Ventures led a USD27.5m round...

-

23 June 2021

Axxon Invests BRL300m to Acquire a Controlling Stake in Alibra (em português)

Axxon agreed to invest up to BRL300m (~USD58m) to acquire a controlling...

-

20 May 2021

GAA Investments Leads BRL10m Seed Round for Brazilian Healthtech LAURA (em português)

GAA Investments led a BRL10m seed round for LAURA, a Braziliant patient...

-

15 May 2021

Appian Capital Advisory to Sell the Caserones Copper Royalty to Nomad Royalty for USD23m

Appian Capital Advisory has entered into an agreement to sell the...

-

10 May 2021

LIV Capital SPAC to Merge with Nexxus Capital-Backed AgileThought

LIV Capital SPAC has agreed to merge with Nexxus Capital-backed...

-

6 May 2021

Inovabra Ventures Leads BRL45m Round for Brazilian ERP Developer Sky.One (em português)

Bradesco’s Inovabra Ventures led a BRL45m round for Sky.One, a Brazilian...

-

12 April 2021

Colombian Credit Platform Avista Secures USD20m Credit Line from Accial Capital

Colombian credit placement platform Avista secured a USD20m credit line...

-

23 March 2021

FTV Capital Leads BRL190m Series B for Brazilian Corporate Trust Platform Vortx (em português)

US-based growth equity fund FTV Capital led a BRL190m Series B for Vortx,...

-

5 March 2021

Astella Investimentos Invests BRL7m in Brazilian Fintech Sled (em português)

Astella Investimentos has invested BRL7m in Brazil-based fintech Sled. ...

-

4 March 2021

Canary Leads USD1.5m Round for Financial Education and Savings Platform Flourish (em português)

Canary led a USD1.5m round for Flourish, a US-based B2B financial...

-

11 February 2021

DOMO Invest Invests R$3.5m in Brazilian Edtech Digital Innovation One (em português)

DOMO Invest invested R$3.5m in Digital Innovation One (DIO), a Brazilian...

-

4 February 2021

Brazil-Focused SPAC Itiquira Raises US$200m via IPO

Brazil-focused Itiquira SPAC has raised US$200m via IPO. The vehicle will...

-

4 February 2021

Redpoint eventures Leads R$3m Seed Round in Brazilian Manufacturing Platform Peerdustry (em português)

Redpoint eventures led a R$3m seed round in Peerdustry, a Brazilian...

-

20 January 2021

Elevar Equity and Global Founders Capital Invest R$35m in Peruvian Grocery Platform Favo (em português)

Elevar Equity and Global Founders Capital invested R$35m in Favo, a...

-

12 January 2021

DOMO Invest and Silver Angels Invest R$1m in Brazilian Satellite Image Processor Sensix (em português)

DOMO Invest and Silver Angels invested R$1m in Sensix, a Brazilian...

-

5 January 2021

Oria Capital Invests R$40m in Brazilian Analytics Platform Knewin (em português)

Oria Capital invested R$40m in Knewin, a Brazilian news and social media...

-

16 December 2020

XP Private Equity Fund Acquires Stake in Pottencial Seguradora for R$275m (em português)

XP Private Equity fund, managed by XP Asset, has acquired a stake in...

-

8 December 2020

Volpe Capital Reaches US$50m First Close for Early Stage Latin America Fund (em português)

Volpe Capital, a VC fund founded by former SoftBank Managing Partner Andre...

-

19 November 2020

Pátria Investimentos will Invest R$3b in Telecom Winity (em português)

Pátria Investimentos has announced the launch of Winity, a telecom...

-

30 October 2020

Viking Global Investors and Advent International Subsidiary Sunley House Capital Invest US$150m in Conductor (em português)

Viking Global Investors led a US$150m round for Conductor, a Brazilian...

-

14 October 2020

Andreessen Horowitz Leads US$48m Series A in Mexican Proptech Casai

Andreessen Horowitz led a US$48m Series A in Casai, a Mexico-based...

-

5 October 2020

Riverwood Capital Leads R$50m Series B Extension for Marketing and Sales Startup Cortex (em português)

Riverwood Capital invested R$50m in a Series B extension in Cortex, a...

-

9 September 2020

Vinci Partners Invests R$400m in Brazilian Digital Bank Agibank (em português)

Vinci Partners has acquired a minority stake in Brazil-based digital bank...

-

27 August 2020

SP Ventures Reaches US$17.2m First Close on Latin American Agfoodtech Fund

SP Ventures reached a US$17.2m first close for its Latin America-focused...

-

24 August 2020

Carlyle-Backed COG Energy Purchases ARROW Exploration's LLA 23 Block for US$12m

Carlyle-backed oil and gas exploration and production company COG Energy...

-

22 August 2020

L Catterton Announces US$150m Private Placement for NYSE Listed Despegar.com

L Catterton has announced a private placement investment of US$150m in...

-

28 July 2020

KPTL Invests in Brazilian IoT Platform Syos (em portugués)

KPTL made an undisclosed investment in Syos, a Brazilian IoT platform...

-

24 July 2020

Redpoint eVentures, Spectra, and Fir Capital Invest R$115m in ABC da Construção (em português)

Redpoint eVentures, Spectra, and Fir Capital made a R$115m follow-on...

-

21 July 2020

Tarpon Invests R$160m in Agrivalle (em português)

Tarpon Investimentos, through it’s agribusiness and food arm 10b,...

-

18 June 2020

L Catterton Invests in Brazilian Marketplace PetLove

L Catterton made an undisclosed investment in PetLove, a Brazilian...

-

9 June 2020

KPTL Acquires Minority Stake in Gestão Agropecuária (em português)

KPTL acquired a minority stake in Gestão Agropecuária, a Brazilian...

-

20 May 2020

Thyssenkrupp Marine Systems to Acquire Oceana Shipyard in Brazil (em português)

German naval company Thyssenkrupp Marine Systems will buy the shipyard...

-

27 April 2020

Advent International-Backed YDUQS Finalizes US$424m Acquisition of Brazilian Workforce Solutions Provider Adtalem Educacional do Brasil (em português)

Advent International-backed Brazil-based educational group YDUQS has...

-

26 March 2020

Capital Invent Fund Leads US$1.4m Pre A Series Round in Dev.f

Capital Invent led a MX$27.6m round in Dev.f, a Mexican edtech for...

-

28 February 2020

Atlantico Leads a R$42m Investment in Trybe (em português)

Atlantico led a R$42m investment in Trybe, a Brazilian edtech focused on...

-

12 February 2020

DOMO Invests R$3m in Bloxs Investimentos (em português)

DOMO Invest made a R$3m investment in Bloxs Investimentos, a Brazilian...

-

5 February 2020

Bridge One Investimentos Invests R$23.5m in Involves (em português)

Involves, a Brazilian trade marketing software platform, raised R$23.5m...

-

4 February 2020

Crescera Investimentos to Exit Afya via Follow-On

Crescera Investimentos will exit educational company Afya via a follow-on...

-

29 January 2020

Smart Money Ventures Leads a R$3m Investment in Gama Academy (em português)

Smart Money Ventures led a R$3m investment in Gama Academy, a Brazilian...

-

22 January 2020

Honey Island Capital Invests R$1-2m in OmniChat (em português)

OmniChat, a Brazilian sales facilitation platform that runs on WhatsApp,...

-

23 October 2019

Mountain Nazca, Foundation Capital, and FEMSA Ventures Invest US$10m in Jüsto

Mountain Nazca, Foundation Capital and FEMSA Ventures made a US$10m seed...

-

2 October 2019

NXTP Ventures Invests US$1.5m in Worcket (en español)

NXTP Ventures made a US$1.5m seed investment in Worcket, an Argentine HR...

-

20 September 2019

Axon Partners Invests in Billpocket

Axon Partners made an undisclosed investment in Billpocket, a Mexican...

-

10 September 2019

Softbank Invests US$250m Series D in Brazilian Apartment Rental Platform QuintoAndar

Brazilian proptech QuintoAndar reached unicorn status with a US$250m...

-

4 September 2019

Accion Venture Lab Launches a New US$33m Fund

Global nonprofit Accion’s seed-stage investment initiative, Accion...

-

8 August 2019

Ameris Capital Acquires a 37% Stake in GNL Mejillones for US$193.5m (en español)

Ameris Capital acquired a 37% stake in GNL Mejillones for US$193.5m. GNL...

-

29 July 2019

Advent Fully Exits IMC through Secondary Market Offering (em português)

Global private equity firm, Advent International, sold its 10% stake in...

-

17 July 2019

Abu Dhabi Investment Authority (ADIA) to Invest in Latin America

Abu Dhabi Investment Authority (ADIA)’s real estate team stated that...

-

8 July 2019

Beagle Ventures Invests US$1.5m in Rankmi

Chilean HR tech startup Rankmi raised US$1.5m from Beagle Ventures....

-

28 June 2019

DOMO Invests R$4m in Instaviagem (em português)

DOMO Invest made a R$4m investment in Instaviagem, a Brazilian travel...

-

28 June 2019

Southern Cross Group and Riverstone Invest US$160m in Aleph (en español)

Southern Cross Group and Riverstone announced plans to jointly invest...

-

11 June 2019

Andreessen Horowitz and Others Invest US$12.5m in ADDI

Andreessen Horowitz invested US$12.5m in ADDI, a Colombian point-of-sale...

-

5 June 2019

SoftBank leads a US$150m Investment in Loggi

SoftBank led a US$150m investment in Loggi, a Brazilian shipping logistics...

-

22 May 2019

Oikocredit Invests US$ 4.7m in Caravela Coffee

Oikocredit Invested US$4.7m in Caravela, a coffee trader in Latin America...

-

16 May 2019

Brazil’s Vinci Closes US$1b Fund III

Vinci Capital Partners announced the final closing of its most recent...

-

7 May 2019

General Atlantic-Backed Arco Educação Acquires Positivo (em português)

Brazilian education company Arco Educação acquired Positivo, an...

-

29 April 2019

Chromo Invest leads Series B Investment in Fitpass (en español)

Chromo Invest led an undisclosed Series B investment in Fitpass, a Mexican...

-

18 April 2019

Abraaj Group’s Private Equity Platform in Latin America Acquired by Colony Capital

The Abraaj Group and Colony Capital, a global investment firm, have signed...

-

9 April 2019

FCP Innovación Leads US$3m Series A in Colombian Startup Leal (en español)

Leal (formerly Puntos Leal), a Colombian consumer rewards platform, raised...

-

5 April 2019

CDPQ & ENGIE Commit US$8.6b to Acquire 90% Stake in Brazil's TAG

Caisse de dépôt et placement du Québec (CDPQ) and ENGIE have made a...

-

4 April 2019

Latinia Leads US$500k Investment in Chilean Fintech Facturedo

Latinia, a Barcelona-based software development company, led a US$500k...

-

28 March 2019

Redwood Ventures Invests US$600k in Mexico's Troquer (en español)

Redwood Ventures made a US$600k investment in Troquer, a Mexican fashion...

-

25 March 2019

GV Angels Leads R$1m Investment in PackID (em português)

GV Angels led a R$1m investment in PackID, a Brazilian food logistics...

-

19 March 2019

Brazilian Publisher Nexo Jornal Raises US$920k from Luminate (em português)

Brazilian publisher Nexo Jornal raised US$920k from Luminate, formerly the...

-

8 March 2019

Smart Money Ventures Invests R$1m in Brazil's Produttivo (em português)

Smart Money Ventures made a R$1m investment in Produttivo, a software...

-

7 March 2019

Softbank Announces US$5b Fund for Latin American Tech

SoftBank announced an initial US$2b commitment on a new SoftBank...

-

5 March 2019

IGNIA Invests US$1.5m in Mexican Fintech Fondeadora

IGNIA invested US$1.5m in Fondeadora, a Mexican open banking platform....

-

15 February 2019

Five Elms Capital Invests US$7m in PlayVox

Five Elms Capital made a US$7m investment in PlayVox, an omnichannel...

-

14 February 2019

L Catterton Acquires Argentine Winery Susana Bello Wines (en español)

Private equity firm L Catterton acquired Argentina-based winery Susana...

-

29 January 2019

monashees & the IFC Lead US$14.3m Investment in Colombian Logistics Platform Liftit (en español)

monashees and the IFC led a US$14.3m Series A in Colombian logistics...

-

25 January 2019

Criatec 3 Invests R$2.5m in Brazilian Software Startup Justto (em português)

Criatec 3, managed by Inseed Investimentos, made a R$2.5m investment in...

-

23 January 2019

Abraaj Group’s Private Equity Platform in Latin America to be Acquired by Colony Capital

The Abraaj Group and Colony Capital, a global investment firm, have signed...

-

18 January 2019

monashees, Mindset Ventures, & Banco Votorantim Invest US$6m in Brazilian Startup WEEL (em português)

monashees, Mindset Ventures and Banco Votorantim made a US$6m investment...

-

29 November 2018

New York VC Palm Drive Capital Leads US$5m Series A in Online Retailer LentesPlus

New York VC Palm Drive Capital led a US$5m Series A in LentesPlus, an...

-

28 November 2018

Redpoint eventures & DGF Invest in Brazilian Startup GESTO (em português)

Redpoint eventures and DGF Investimentos made an undisclosed Series B...

-

22 November 2018

Blue Equity Executes First Phase for the Sale of Mexican Resort

Private equity firm Blue Equity executed the first phase for the...

-

14 November 2018

Elevar Equity Leads US$5.25m Investment in Uruguayan Fintech Bankingly

Elevar Equity led a US$5.25m investment in Uruguayan digital banking...

-

30 October 2018

Sequoia Capital Invests US$2.25m in Mexican Startup Rever (en español)

Sequoia Capital and Zetta Venture Partners invested US$2.25m in Rever, a...

-

11 October 2018

Family Office Leads R$5m Investment in Brazilian E-Commerce Locker Startup Alfred (em português)

The Gontijo family office led a R$5m investment in Alfred, a Brazilian...

-

10 October 2018

Altor Estructuradores to List CKD Vehicle on Mexico’s BIVA (en español)

Altor Estructuradores is preparing to list a CKD on Mexico’s BIVA for...

-

8 October 2018

CyrusOne Invests US$12m in Patria Investments' ODATA Brasil and ODATA Colombia

CyrusOne, a global data center REIT, announced it will make a US$12m...

-

5 October 2018

Vector Inovação e Tecnologia Acquires Brazilian Fintech Beblue (em português)

Vector Inovação e Tecnologia (Vit) acquired a controlling stake...

-

13 September 2018

GC Capital Announces First Close of MXN100m for its Second Fund (en español)

Mexican venture firm GC Capital announced a first close of MX$100m for its...

-

20 August 2018

The Venture City, Velum Ventures & Grupo Cisneros Lead US$4.5m Series A in Social Marketing Platform Fluvip (en espanol)

The Venture City, Velum Ventures and Grupo Cisneros led a US$4.5m Series A...

-

15 August 2018

Mercado Libre's MELI Fund & Others Make US$3m Investment in Fintech Increase (en español)

Mercado Libre’s MELI Fund, and Agrega Partners made a US$3m investment...

-

14 August 2018

Alba Capital Partners Acquires Argentinean Telecoms Sidaco and A1T

Alba Capital Partners acquired controlling interests in Argentinean...

-

8 August 2018

Omidyar Network Launches Impact Investing Team

The Omidyar Network has launched a new impact investing guide for...

-

7 August 2018

Credicorp Capital and Greystar Raise US$100m for Chilean Residential Income Fund II (en español)

Credicorp Capital and Greystar broke records in the Chilean market after...

-

31 July 2018

GTIS Partners Launches Infrastructure Platform in Brazil

GTIS Partners announced that it will expand into infrastructure investing...

-

28 July 2018

KaszeK Ventures & SOS Ventures Invest US$3m in Chilean Foodtech NotCo

KaszeK Ventures and SOS Ventures made a US$3m investment in NotCo, a...

-

9 July 2018

Vinci Partners Acquires 70% of Brazilian CURA Imagem e Diagnóstico Group (em português)

Vinci Partners acquired a 70% stake in Brazilian healthcare diagnostics...

-

9 July 2018

Brazilian Big Data Analytics Platform Priced Receives US$2m Series A

An unnamed family office made a US$2m Series A investment in Priced, a...

-

3 July 2018

Astella Investimentos Leads US$1.2m Seed Investment in Brazilian CRM SumOne (em português)

Astella Investimentos made a US$1.5m seed investment in SumOne, a CRM for...

-

18 June 2018

Vostok Emerging Finance Leads US$25m Series C in Mexican Fintech Konfio

Vostok Emerging Finance led a US$25m Series C investment in Konfio, a...

-

15 June 2018

Alsagra Ventutres, Ajba Software, and Intelectix Invest in Mexican Cloud E-commerce Platform Muventa (en español)

Alsagra Ventures, Ajba Software and Intelectix made an undisclosed...

-

8 June 2018

Principia Capital Partners Seeks to Raise US$400m to Invest in Brazilian Mid-Sized Businesses (em português)

Principia Capital Partners, a spin-off of Victoria Capital Partners, seeks...

-

8 June 2018

Bzplan and FIR Capital Make R$3m Investment in Brazilian Marketing Startup PhoneTrack

Bzplan and FIR Capital made a R$3m investment in PhoneTrack, a Brazilian...

-

18 May 2018

Spain’s Banco Sabadell Invests in Mexican Mobile Fashion Marketplace Trendier (en español)

Spanish bank Banco Sabadell has made its debut early stage investment in...

-

18 May 2018

EIG Announces US$758m Financing for Chilean Solar Power Company Cerro Dominador

Chile’s Cerro Dominador, a portfolio company of EIG Global Energy...

-

27 April 2018

Graycliff Partners' Latin America Team Spins-Off to Form Bela Vista Investimentos

The Latin America Group of Graycliff Partners has spun-off to form an...

-

24 April 2018

Amistad Global To Expand Industrial Portfolio (en español)

Mexican real estate developer Amistad Global Development, through its...

-

17 April 2018

MIRA Acquires Land in Querétaro for Mixed-Use Project (en español)

Investment and real estate platform MIRA has acquired land for a new...

-

13 April 2018

LLR Partners Leads US$31m Series C in Argentine Cypersecurity Startup Onapsis

LLR Partners led a US$31m Series C in Argentine cybersecurity startup...

-

10 April 2018

Undisclosed Angels Invest in Brazil's Benvenuto (em português)

Undisclosed angels made an undisclosed investment in Benvenuto, a...

-

2 April 2018

Lone Star Lends US$200m to Odebrecht's Atvos (en español)

Dallas-based private equity firm Lone Star Funds has provided US$200m in...

-

8 March 2018

Medici Ventures Makes Follow-On Investment in Bitt

Medici Ventures made a US$3m follow-on investment in Bitt, a...

-

28 February 2018

Invus Opportunities Invests in Brazilian Edtech Platform Descomplica (em português)

Invus Opportunities made a R$54m investment in Brazilian edtech...

-

19 February 2018

CONSAR Seeking to Increase Afores Investment Limits for Infrastructure (en español)

Mexico’s National Commission of Savings Systems for Retirement...

-

12 February 2018

Fir Capital BZPlan Invests R$2m in Brazil's Gofind.Online (em português)

Fir Capital Bzplan invested R$2m in Gofind.Online, a Brazilian local...

-

11 February 2018

Axon Partners Invests in Peruvian Dating App Mi Media Manzana (en español)

Axon Partners made its first Peru investment in Mi Media Manzana, a dating...

-

25 January 2018

Mexico Expand Investment and Diversification Options for AFORES

According to recent adjustments to the SIEFORES policy, Mexican Afores...

-

21 January 2018

IGNIA & Global Founders Lead US$2.5m Investment in Brazilian Startup DogHero (em português)

IGNIA Partners and Global Founders Capital led a US$2.5m investment in...

-

16 January 2018

TriLinc Approves Financing for Latin America Impact Investing

TriLinc Global Impact Fund approved US$22.7m in term loans and trade...

-

15 January 2018

DILA Capital Invests US$1.6m in Camino Financial

Dila Capital led a US$1.6m investment in Camino Financial, an online loan...

-

10 January 2018

IFC Invests R$15m in Brazilian Fintech Startup Koin (em português)

The International Finance Corporation (IFC) led a R$15m investment in...

-

29 November 2017

Bozano Investimentos Invests in EAC Software (em português)

Brazilian private equity firm Bozano Investimentos has made an undisclosed...

-

22 November 2017

Devlabs Ventures Launches Chile Outlier Seed Fund I (en español)

DevLabs Ventures has launched the Chile Outlier Seed Fund I with a target...

-

20 November 2017

Pomona Impact Injects US$150k into Guatemala's Ecofiltro (en español)

Pomona Impact has made a US$150k investment in Ecofiltro, a social impact...

-

14 November 2017

2017 Brazil Fintech Regulatory Breakdown: Crowdfunding, Blockchain & Crypto (em português)

Law firm Baptista Luz shares the status of several regulatory issues in...

-

18 September 2017

Bamboo Capital & IFC Invest in Chile's ComparaOnline

Bamboo Capital and the IFC made a US$14m investment in ComparaOnline, a...

-

22 August 2017

Canary and Yellow Ventures Invest R$1.5m in HRtech Startup Gupy (em português)

Canary and Yellow Ventures invested R$1.5m in Gupy, an HR platform...

-

17 August 2017

IGNIA Makes Five Investments in 2017 (en español)

Mexican VC IGNIA invested in five startups this year: Apli, AirTM,...

-

16 August 2017

CPPIB and CCP Commit US$400m to Brazilian Office Joint Venture

After closing a portfolio exchange, Canada Pension Plan Investment Board...

-

13 July 2017

Parallel18 Ventures Invests in BrandsOf, Timokids and Be Better Hotels to Expand Throughout Puerto Rico (en español)

Puerto Rico accelerator Parallel18 invested US$75k each (US$225k total) in...

-

22 June 2017

Northgate Invests MXN$250m in Mexico's Natgas (en español)

Northgate Capital México completed an investment of MXN$250m in Natgas...

-

21 June 2017

Y Combinator Invests in Colombian Startup Tpaga (en español)

Y Combinator will invest more than US$100k in Colombia-based mobile...

-

19 May 2017

Jaguar to Close Final Deal of LatAm Real Estate Fund

Jaguar is currently in the process of completing the final deal of its...

-

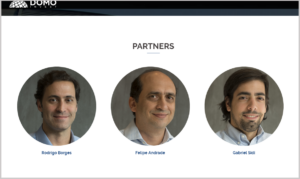

29 March 2017

DOMO Raises R$100m from Brazilian Family Offices to Invest in Startups (em português)

DOMO Invest, a venture capital fund launched by Buscapé Co-Founder...

-

22 March 2017

Variv Capital Invests in MPower

VARIV Capital has invested in the latest investment round (Series A) of...

-

17 March 2017

Canary and monashees+ Invest R$2m in IDwall (em português)

Canary and monashees+ invested R$2m (~US$600k) in IDwall, a Brazilian...

-

21 February 2017

L Catterton Partners with Grupo de Narváez to Expand Argentina's Rapsodia in the Region (en español)

L Catterton partnered with Grupo de Narváez to make its debut investment...

-

14 February 2017

ALLVP Makes Follow-On Investment in Mexican Solar Power Provider Enlight

ALLVP made an undisclosed Series B follow-on investment, alongside...

-

31 January 2017

Former Buscapé Executives Launch Venture Fund Domo Invest (em português)

Two former Buscapé executives, Ridrigo Borges and Guga Stocco, have...

-

23 January 2017

Axon Partners Group Leads Round in Mexico's Simpati Mobile (en español)

Axon Partners Group led an investment in Simpati Mobile via its fund,...

-

18 January 2017

Mountain Nazca and Accion Invest in Destacame.cl

Venture Capital firms Mountain Nazca and Accion, alongside angel...

-

18 January 2017

Rise Capital Leads US$5m Series A in Colombia's OFI (en español)

Rise Capital led a US$5m Series A in B2B e-commerce platform OFI, with...

-

12 December 2016

Bossa Nova Invests ~R$1m in Brazilian Online Shoe Retailer 33e34 (em português)

Bossa Nova Investimentos invested close to R$1m in the Brazilian online...

-

7 December 2016

Mountain Nazca Leads US$3m Investment in Kavak (en español)

(Expansión) Latin American venture capital fund Mountain Nazca has led a...

-

15 November 2016

UNICEF Makes Venture Capital Investments in Emerging Market Tech Startups

(UNICEF) UNICEF has invested in Nicaragua’s Saycel, which provides...

-

14 November 2016

Southern Cross to Issue First CKD (en español)

(El Economista) Southern Cross, a private equity firm with a presence in...

-

4 November 2016

RD Receives R$62m Investment from TPG Growth (em português)

(IDGNow!) TPG Growth led a US$19.2m (R$62m) investment in Resultados...

-

19 October 2016

Dalus Capital's Rogelio de los Santos Seeks Next LatAm Success Story (en español)

(Pulso Social) After six years with Alta Ventures Mexico, Rogelio de los...

-

11 October 2016

Primatec Invests in Brazilian Startup Myleus Biotecnologia (em português)

(Startupi) Primatec has closed investment negotiations with the Brazilian...

-

6 October 2016

Dalus Capital Fund II Launches US$50m CKD

(Press Release) Dalus Capital Fund II issued its first CKD for MX$950m...

-

23 September 2016

Leiturinha Receives R$3m from Movile (em português)

(Exame) Brazilian corporate venture investor Movile has invested R$3m...

-

1 September 2016

2016 Mid-Year Data & Analysis

2016 LAVCA Mid-Year Data & Analysis is a PDF report providing an...

-

7 July 2016

2015 Mid-Year Data and Analysis

2015 LAVCA Mid-Year Data & Analysis is a PDF report providing an...

-

7 July 2016

2015 LAVCA Industry Data and Analysis

2015 LAVCA Industry Data & Analysis is a PDF report providing an...

-

7 July 2016

2014 Mid-Year Data and Analysis

2014 LAVCA Mid-Year Data & Analysis is a PDF report providing an...

-

7 July 2016

2014 Venture Investing Snapshot: LatAm Trends

Venture capital investors active in Latin America deployed US$425m in 2013...

-

6 July 2016

2013 LAVCA Mid-Year Data & Analysis

2013 LAVCA Mid-Year Data & Analysis is a PDF report providing an...

-

6 July 2016

2011 LAVCA Mid-Year Data & Analysis

2011 LAVCA Mid-year Data & Analysis is a PDF report providing an...

-

4 July 2016

Variv Capital Partially Exits Wallopop

(AMEXCAP) VARIV Capital exits part of its investment in Wallapop. This...

-

1 July 2016

Carlyle Peru Invests in Tourist Operator Inca Rail

(PEHub) Carlyle Group invested in the Inca Rail, a tourist train operator...

-

10 June 2016

Angel Ventures Prepares US$100m VC Fund (en español)

(El Financiero) Angel Ventures Mexico announced it will close a new...

-

24 May 2016

Online Mexican Lending Platform Konfio Raises US$8m in New VC Funding

(PEHub) Konfio, an online Mexican lending platform, has raised US$8m in...

-

11 May 2016

South Ventures Makes Follow-On Investment in Trocafone (en español)

(IG Angels) Brazilian e-commerce startup Trocafone has received a...

-

9 May 2016

BNDES to Commit R$550m to Five Fund Managers (em português)

(BNDES) In an effort to promote the development of the infrastructure,...

-

25 April 2016

New Argentine VC fund AR Fintech Raises US$5m (en español)

(La Nacion) New Argentine VC fund AR Fintech has raised US$5m, the...

-

21 April 2016

Mexican Fintech Startup Kueski Raises US$35m

(Businesswire) Kueski has closed a US$35M round of equity and debt...

-

13 April 2016

Pátria Investimentos Enters the Energy Transmission Sector (em português)

(Press Release) Pátria Investimentos’ infrastructure Fund III will...

-

11 April 2016

Tempest Security Receives R$28.2m Investment from FIP Aeroespacial (em português)

(Press Release) Brazilian digital security company Tempest Security...

-

7 April 2016

With Two Acquisitions, Adavium Medical Now Largest Brazilian Medical Equipment & Diagnostics Company in Brazil

(Press Release) Adavium Medical announced the acquisitions of Alka...

-

1 April 2016

Sigma Safi Acquires Two Wind farms in Peru (en español)

(Sigma) Sigma Safi has acquired a 49% stake in the Peruvian wind...

-

29 March 2016

Summit Agricultural Group Leads US$115m Investment in F&S Agri Solutions

(Press Release) US-based Summit Agricultural Group has made a US$115m...

-

17 March 2016

Monterra Energy Announces Strategic Pipeline Project in Central Mexico

(Businesswire) Monterra Energy, a firm that received an equity commitment...

-

26 February 2016

General Atlantic to Exit Sura Asset Management for US$538m (en español)

(Dinero) Grupo Sura signed an agreement to buy back its stake in Sura...

-

23 November 2015

Omnicom Group's DDB Worldwide Acquires Grupo ABC, Giving Kinea Investments a Full Exit

(PR Newswire) DDB Worldwide, a division of Omnicom Group Inc., announced...

-

16 November 2015

Trocafone Receives R$12m Investment to Expand to Argentina (em português)

(E-Commerce) Trocafone, a Brazilian e-commerce startup, received a R$12m...

-

4 November 2015

Chilean Fund Raising US$50m for Permanent Crops in Colombia

(Agri Investor) A Chilean agrifocused private equity firm, Sembrador,...

-

25 October 2015

Ignia Targets US$100m for Second Fund

(El Economista) 8 years after raising its first investment fund for...

-

7 October 2015

Hemisfério Sul Investimentos Invests R$88m in Grupo Madero (em português)

(Jornal da Manha) Brazilian restaurant chain Grupo Madero has received an...

-

4 August 2015

Riverstone Launches CKD for Energy Projects (en español)

(El Financiero) Private Equity fund, Riverstone, which finances Sierra Oil...

-

14 July 2015

Stratus Group's Flex Contact Center Joins Forces with RR Group

(Press Release) Transaction consolidates Flex’s relationship management...

-

2 July 2015

Axxon Closes US$400m for its Third Fund (em português)

(Valor Econômico) Investment fund Axxon successfully closed US$400m for...

-

30 June 2015

Motor Scooter Startup EConduce Receives Round of Capital (en español)

(El Financiero) EConduce, a Mexico-City based electric moto scooter...

-

23 June 2015

Undertone Acquires Argentinian Startup Sparkflow, Cygnus Capital's First Exit (en español)

(Pulso Social) Undertone, a U.S. company specializing in digital marketing...

-

22 May 2015

IdeiasNet Injects R$50m in Officer (em português)

(Baguete) Officer, Brazil distributor of IT products, announced receiving...

-

6 May 2015

Lexington Partners Promises to Renovate Three Schools in Latin America with Happy Hearts Fund (en español)

(Press Release) Happy Hearts Fund, a non-profit organization and 501(c)(3)...

-

22 April 2015

BlablaCar Acquires Mexican Ridesharing Platform Aventones

(Press Release) French US$100M-funded global leader, BlablaCar acquired...

-

16 April 2015

In Latest Deals Investor Kaszek Ventures Doubles Down On Women Entrepreneurs

(TechCrunch) Latin American powerhouse investors Kaszek Ventures have...

-

30 March 2015

BlackRock, First Reserve to Acquire Equity Stake of US$900m in Mexican Pipeline

(Press Release) BlackRock and First Reserve have entered into a definitive...

-

3 March 2015

Altus and HT Receive an Investment from Finep (em português)

(Baguete) Altus and HT Micron, two electronics companies based in São...

-

16 January 2015

Partners Group to Finance Telecommunication Between New York & São Paulo

(Dow Jones) In a bid to boost communications capabilities between North...

-

3 December 2014

South Ventures Invests in Colombia's Formafina (en español)

(South Ventures) South Ventures participated in Formafina’s new...

-

5 November 2014

Zenvia Raises R$71m from BNDESPar and DLM

Zenvia, a mobile services company headquarters in Porto Alegre, has just...

-

15 October 2014

AlaMaula Founder Invests in South Ventures

(South Ventures) The Founder of AlaMaula invested in South Venture’s...

-

25 September 2014

Finance Startup Nubank Nabs US$14.3m, Sequoia’s First Brazil Investment

(TechCrunch) Nubank, a financial services startup based in Brazil, is...

-

6 August 2014

Do You Want to Become a Trendsetter in the Entrepreneurial World?

IDB/MIF (the Multilateral Investment Fund of the inter-American...

-

14 July 2014

Southern Cross Group to Acquire SIPSA Interest in Ultrapetrol

(Press Release) The major shareholders of Ultrapetrol (Bahamas) Limited...

-

23 May 2014

CRP Fund Buys 25% of Aquiris (em português)

(Baguete) Aquiris, Porto Alegre’s digital game developer, announced...

-

1 April 2014

Pacific Rubiales Announces Closing of US$385m Sale of its OCENSA Pipeline Interest

(WSJ) Pacific Rubiales Energy Corp announced today the closing of the...

-

23 December 2013

Bricapital Makes Strategic Investment in Colombia’s First Hyatt Regency Hotel

(National Post) Bricapital, a Colombia-based private equity firm focused...

-

22 November 2013

Riverwood Capital Invests R$30m in Pixeon Medical Systems (em português)

(Baguete) Pixeon Medical Systems, a developer of IT solutions for...

-

16 October 2013

FUNCEF Debuts New Investment Model in Private Equity

(Reuters) Unlike the policy adopted historically by Brazilian foundations,...

-

21 July 2013

Arm of World Bank Places Big Bet on Brazil

(Press Release) The World Bank’s private sector arm is betting big on...

-

12 July 2013

e.Bricks Early Stage Leads First Round of Investment in GuiaBolso (em português)

(Startupi) GuiaBolso announced that it received its first round of...

-

9 July 2013

MercadoLibre Announces First Three Investments in Startups for a Total of US$300,000 (en español)

(Pulso Social) A few months ago, MercadoLibre and Wayra announced their...

-

10 May 2013

Santander acquires 23% of Ambievo (em português)

(Época Negócios) Santander Brazil purchased 23% of Ambievo, a company...

-

25 April 2013

Renovalia Reserve Investment Platform Expands with the Addition of Two Onshore Wind Power Plants in Mexico

(PRNewswire) GREENWICH, Conn., MADRID, and LONDON — The First...

-

31 January 2013

WAMEX makes fourth investment of Mexico PE Fund MIF II in Productos Medix

WAMEX announces the fourth investment of its Mexico PE Fund MIF II in...

-

17 December 2012

Aurus acquires office building assets from Union Investment (en español)

(Economia y Negocios) December 14, 2012 – Aurus acquires office...

-

30 November 2012

2012 LAVCA Mid-Year Data & Analysis

2012 LAVCA Mid-year Data & Analysis is a PDF report providing an...

-

7 November 2012

Astella Investimentos has Invested in Moblife (em português)

(Astella Investimentos) November 7, 2012 – Astella Investimentos has...

-

4 October 2012

Rio Bets It Can Become Brazil's Silicon Beach

(New York Times) October 4, 2012 – For years, Rio de...

-

3 October 2012

Intel Capital announces investment in PagPop (em português)

(Intel Capital) October 3, 2012 – Intel Capital announced a range...

-

28 September 2012

500Startups invests in 9 additional Mexican companies

(VentureBeat) September 28, 2012 – 500Startups announced that it has...

-

20 September 2012

Minuto Seguros Announces Series A Investment from Redpoint e.ventures

(Redpoint e.ventures) September 20, 2012 – Minuto Seguros, the leading...

-

10 July 2012

Spanish PE firms merge to form N+1 Mercapital

(Financial News) July 10, 2012 – Spanish private equity firms...

-

22 May 2012

ChileGlobal Angels & Peru Capital Network Announce Partnership (en español)

(Diario Financiero) May 22, 2012 – ChileGlobal Angels, the angel...

-

16 April 2012

BR Partners Secures Sequoia Stake (em português)

(O Estado de S.Paulo) April 16, 2012 – The private equity arm of...

-

9 March 2012

ABVCAP Announces New President (em português)

(ABVCAP) March 9, 2012 – The Brazilian Private Equity & Venture...

-

27 October 2011

LatAm-focused Latin Idea and MPOWER Ventures among Impact Investing Funds Selected by OPIC

(OPIC) October 27, 2011 – Impact investing, a fast-growing industry...

-

20 October 2011

Advent International Opens New Office in Colombia

(Advent International) October 20, 2011 – Advent International, one...

-

6 September 2011

Aureos Invests in Mexican Toy Distributor

(Aureos Capital) September 6, 2011 – The Aureos Latin America Fund...

-

16 August 2011

Patria Raises US$1.25 Bln for Private Equity Fund (em português)

(O Estado de S. Paulo) August 16, 2011 – Brazil-based Patria...

-

14 July 2011

MIF Supports VC Regional Fund AGF Latin America Fund

(The MIF) July 14, 2011 – The Multilateral Investment Fund (MIF)...

-

26 April 2011

Gávea Raises R$1 Bln in Three IPOs

(Valor Economico) April 26, 2011 – Six months after JP Morgan bought...

-

12 April 2011

Analysis: Private equity wary of Brazil currency, prices

(Reuters) April 12, 2011 – Brazil’s policy stalemate over...

-

7 March 2011

Conduit Capital to Tap $150M from Mexican Pension Funds

(Dow Jones Newswires) March 7, 2011 – New York-based Conduit Capital...

-

7 July 2010

Confessions Of A VC Who Raised Money During Financial Armageddon

By Alan J. Patricof, Founder & Managing Director – Greycroft,...

-

6 July 2010

2010 LAVCA Industry Data

2010 LAVCA Industry Data & Analysis is a PDF report providing an...

-

16 April 2010

Banco Modal to Start $1 Billion Private Energy Fund

(Bloomberg) April 16, 2010 – Banco Modal SA, the Brazilian bank that...