Search Results

Search results for: "nubank" in All Categories

-

6 June 2024

Nubank Surpasses Itau in Market Cap; Mexico Elects First Woman President

-

21 June 2022

Brazil’s Nubank plots consolidation in Latin America’s booming fintech sector (paywall)

-

8 June 2021

Berkshire Hathaway Leads USD750m Series G Extension For Nubank

Berkshire Hathaway led a USD750m Series G extension for Nubank, with...

-

28 January 2021

GIC, Whale Rock, and Invesco Lead US$400m Series G in Nubank

GIC, Whale Rock, and Invesco led a US$400m Series G in Nubank at a US$25b...

-

11 September 2020

Advent Exits Brazilian Investment Platform Easynvest and Invests in Nubank

Advent International has agreed to sell its stake in Brazil-based digital...

-

26 July 2019

Crunchbase: Latin America-Based Nubank To Raise $400M At A $10B Valuation

-

26 July 2019

TCV Leads US$400m Series F Invesment in Nubank

Brazilian fintech Nubank raised a US$400m Series F at a reported US$10b...

-

1 July 2019

Portal Do Bitcoin: Nubank é a startup de US$ 10 bilhões que você nunca ouviu falar, diz site dos EUA

-

17 June 2019

Nubank Raises R$375m Using a Brazilian Form of a Fixed-Income Issuance (em português)

Nubank raised R$375m using a Brazilian form of a fixed-income issuance....

-

8 October 2018

Tencent Invests US$180m in Brazilian Financial Services Startup Nubank

Nubank doubled its valuation to US$4b this year with a US$180m investment...

-

1 March 2018

Brazil's Nubank Raises US$150m in Series E Round Led by DST Global

DST Global led a US$150m investment in Brazilian fintech Nubank, with...

-

8 December 2017

FIDC Invests R$250m in Nubank (em português)

Nubank closed a new R$250m credit line from FIDC (Fundo de Investimentos...

-

7 December 2016

Brazil's Nubank Receives US$80m Series D

(New York Times) DST Global, the investment firm started by Russian...

-

27 April 2016

Nubank Receives R$200m Injection from Goldman Sachs (em português)

(Valor Econômico) Brazilian fintech startup Nubank has received a R$200m...

-

7 January 2016

Founders Fund Leads a Financing Round for Nubank, a Brazilian Start-Up

(DealBook) Brazilian start-up Nubank, a mobile-based credit card business,...

-

2 June 2015

Brazil’s Nubank Raises US$30m Led By Tiger To Build Out Its Mobile-Based Credit Card Business

(TechCrunch) Brazil is one of the world’s fastest growing mobile...

-

25 September 2014

Finance Startup Nubank Nabs US$14.3m, Sequoia’s First Brazil Investment

(TechCrunch) Nubank, a financial services startup based in Brazil, is...

-

8 November 2022

Chan Zuckerberg Initiative Leads Series C for Brazil’s Beep Saúde

(Startupi) CZI, the investment arm of the Chan Zuckerberg Initiative, led...

-

27 September 2022

Chromo Invest, Canary, Others Invest BRL9m in Brazil’s Civi; Canary Leads USD1.1m in Pre-seed Round for Mexico’s Bendo

(Pipeline | LatamList) Chromo Invest led a BRL9m (~USD1.7m) round for...

-

17 August 2022

2022 Latin American Startup Directory

LAVCA’s seventh annual Latin American Startup Directory profiles 523...

-

11 February 2022

2022 LAVCA Industry Data and Analysis

The 2022 Industry Data & Analysis includes data and insights on...

-

7 February 2022

2022 LAVCA Trends in Tech

Access LAVCA’s 2022 LAVCA Trends in Tech, which breaks down 2021 VC...

-

26 October 2021

SoftBank Leads USD75m Series C for Brazilian BPO Platform Pipefy

SoftBank invested USD50m in a USD75m Series C for Pipefy, a Brazilian...

-

25 October 2021

Brazilian Car Insurtech Justos Raises ~USD35.8m Series A from SoftBank, KASZEK and Others

Justos, a Brazilian pre-launch car insurance platform, raised a ~USD35.8m...

-

5 October 2021

Mercado Libre and KASZEK SPAC Raises USD287m In Public Listing

MELI Kaszek Pioneer Corp (MEKA), a SPAC formed by Mercado Libre and...

-

30 September 2021

YC and Public.com Lead USD5.7m Seed Round for Retail Investment Platform Sprout

YC and NY-based retail investment platform Public.com led a USD5.7m seed...

-

28 September 2021

Advent International and SoftBank Lead USD225m Series B for E-commerce Aggregator Merama

Advent International and SoftBank led a USD225m Series B for Merama, a...

-

1 September 2021

KASZEK and monashees Lead ~USD9m Seed Round for Brazilian Lending Platform TruePay (em português)

KASZEK and monashees led a ~USD9m seed round for TruePay, a Brazilian...

-

18 August 2021

Greenoaks and Tencent Lead USD120m Series E+ for Brazilian Proptech QuintoAndar

Greenoaks and Tencent led a USD120m Series E+ for Brazilian proptech...

-

22 June 2021

Y Combinator Leads USD2.5m Round for Brazilian Fintech Conta Simples (em português)

Y Combinator led a USD2.5m round for Conta Simples, a Brazilian finance...

-

18 June 2021

QED Investors Leads USD30m Series B for Brazilian Solar Energy Financing Platform Solfácil

QED Investors led a USD30m Series B for Solfácil, a Brazilian solar...

-

1 June 2021

Mexican Fintech Belvo Raises USD43m Series A

Belvo, a Mexican fintech providing a financial services API for mobile...

-

25 May 2021

Ribbit Capital Leads BRL53m Series A for Brazilian Pension Fund Management Platform Onze (em português)

Ribbit Capital led a BRL53m Series A for Onze, a Brazilian pension plan...

-

5 May 2021

Canary, Dragoneer and Rainfall Ventures Lead USD8m Seed Round for Brazilian Insurtech 180 Seguros

Canary, Dragoneer Investment Group and Rainfall Ventures led a USD8m seed...

-

4 May 2021

Union Square Ventures Leads USD5.5m Series A for Brazilian Neobank alt.bank

Union Square Ventures led a USD5.5m Series A for alt.bank, a Brazilian...

-

28 April 2021

GIC Leads BRL300m Series C for Brazilian Digital Brokerage Warren

GIC led a BRL300m Series C in Brazilian digital brokerage Warren, with...

-

20 April 2021

QED Investors Leads UDD15m Series B for Brazilian Payment Services Provider Hash

QED Investors led a USD15m Series B for Hash, a Brazilian payment services...

-

14 April 2021

Valor Capital Group Leads USD20m Series B for Home Care Platform Beep Saúde

Valor Capital Group led a USD20m Series B for Beep Saúde, a Brazilian...

-

7 April 2021

QED Investors Leads USD12m Series A for Mexican Freight Marketplace Nuvocargo

QED Investors led a USD12m Series A for Nuvocargo, a Mexican freight...

-

27 January 2021

QED Investors Leads US$6m Round in Lending Platform Milo

QED Investors led a US$6m round in Milo, a Colombia- and Miami-based...

-

15 January 2021

KaszeK Ventures Leads R$20m Series A in Brazilian Customer Service Platform OmniChat

KaszeK Ventures led a R$20m Series A in OmniChat, a Brazilian chat-based...

-

13 January 2021

Astella Investimentos Leads R$11m Round in Brazilian Corporate Training Platform Skore (em português)

Astella Investimentos led a R$11m round in Skore, a Brazilian corporate...

-

10 December 2020

KaszeK Ventures and QED Investors Lead US$62m Series B in Bitso

KaszeK Ventures and QED Investors led a US$62m Series B in Bitso, a...

-

3 December 2020

Accion Venture Lab, Emles Venture Partners, and Noveus VC Invest US$1.5m in Henry

Accion Venture Lab, Emles Venture Partners, and Noveus VC invested US$1.5m...

-

1 October 2020

Advent Enters Strategic Partnership with Brazilian Chocolate Producer Grupo CRM

Advent International has entered a strategic partnership with Brazil-based...

-

29 September 2020

Advent International Raises US$2b for LAPEF VII Fund

Advent International has raised a US$2b final close for Advent Latin...

-

11 July 2020

QED Investors, KaszeK Ventures, and Others Invest US$22.5m Series B in Digital Brokerage Warren

QED Investors led a US$22.5m Series B in Brazilian digital brokerage...

-

1 July 2020

Canary, KaszeK Ventures, and MAYA Capital Invest US$16m in Alice

Canary, KaszeK Ventures, and MAYA Capital invested US$16m in Alice, a...

-

22 June 2020

Global Founders Capital, ONEVC, and Flourish Ventures Invest in Brazilian Fintech Swap

Global Founders Capital, ONEVC, and Flourish Ventures made an undisclosed...

-

16 June 2020

Kaszek Ventures Leads a US$10m Series A in Colombian Proptech La Haus

KaszeK Ventures led a US$10m Series A in La Haus, a Colombian proptech for...

-

11 June 2020

monashees, KaszeK Ventures, and ONEVC Invest US$4.6m in Pipo (em Português)

monashees, KaszeK Ventures, and ONEVC invested US$4.6m in Pipo, a...

-

29 May 2020

KaszeK Ventures and Founders Fund Lead a US$10m Investment in Mexican Fintech Belvo

Belvo, a Mexican fintech providing a financial services API platform for...

-

27 February 2020

QED Investors Closes Its Sixth Fund with US$350m in Commitments

QED Investors closed its sixth fund with US$350m in commitments....

-

18 February 2020

Kinea Acquires Stake in Matera (em português)

Private Equity manager Kinea, the alternative asset management subsidiary...

-

29 January 2020

Smart Money Ventures Leads a R$3m Investment in Gama Academy (em português)

Smart Money Ventures led a R$3m investment in Gama Academy, a Brazilian...

-

15 January 2020

Banco BV invests R$25m in Personal Finance App, Olivia (em português)

banco BV (formerly Banco Votorantim) led a R$25m investment in Olivia, a...

-

15 January 2020

Canary and Wayra Brasil Exit Teravoz Through a Sale to Twilio

Teravoz, a Brazilian VoIP services provider to small businesses and call...

-

3 January 2020

Andreessen Horowitz, Vulcan Capital, Jaguar Ventures and Others Invest US$175m Series C in Loft

Andreessen Horowitz and Vulcan Capital led a US$175m Series C in Brazilian...

-

11 December 2019

Valar Ventures Leads a Series A US$19m in Albo

Valar Ventures led a US$19m extension to Mexican fintech Albo’s Series...

-

5 December 2019

monashees, Valor Capital, and Canary Invest R$38m in Mimic (em português)

monashees, Valor Capital, and Canary invested R$38m in Mimic, a Brazilian...

-

25 November 2019

Tencent and SoftBank Lead a US$150m Series C Investment in Ualá

Tencent and SoftBank led a US$150m investment in Ualá, an Argentine...

-

17 October 2019

ALLVP and InQlab Invest ~US$2.5m in Slang (en español)

ALLVP and InQlab invested ~US$2.5m in Slang, a Boston-based edtech focused...

-

4 October 2019

KaszeK Ventures Leads a R$7m Investment in Theia, founded by Flávia Deutsch & Paula Crespi (em português)

KaszeK Ventures led a R$7m investment in Theia, a Brazilian family support...

-

30 September 2019

Ribbit Capital Leads a R$35m Investment in Gorila Invest (em português)

Ribbit Capital led a R$35m investment in Gorila Invest, a Brazilian...

-

17 September 2019

Vostok Emerging Finance Leads a US$13m Investment in Xerpa (em português)

Vostok Emerging Finance led a US$13m investment in Xerpa, a Brazilian...

-

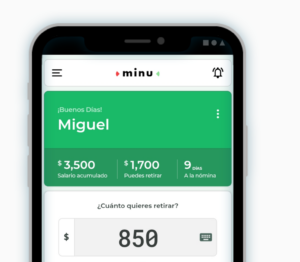

4 September 2019

QED Investors, Village Global, Next Billion Ventures, and Mountain Nazca Mexico Invest US$6.5m in minu

minu, a payroll fintech providing Mexican employees digital access to...

-

3 September 2019

Base Partners Closes a US$135m Fund II

Base Partners, a Brazilian growth equity firm, closed a US$135m Fund II....

-

29 August 2019

KaszeK Ventures Raises US$600m Across Two New Funds

KaszeK Ventures raised US$600m across two new funds, including US$375m for...

-

29 July 2019

Softbank Acquires ~R$1b in Shares of Banco Inter (em português)

SoftBank acquired ~R$1b in shares of Banco Inter, a publicly traded...

-

11 June 2019

Andreessen Horowitz and Others Invest US$12.5m in ADDI

Andreessen Horowitz invested US$12.5m in ADDI, a Colombian point-of-sale...

-

9 May 2019

KaszeK Ventures, Redpoint e.ventures and QED Investors Invest R$16m Series A in Xerpa (em português)

KaszeK Ventures, Redpoint eventures and QED Investors made a R$16m Series...

-

6 May 2019

Inside Another Record Breaking Year: 2019 Review of Tech Investment

Access LAVCA's Annual Review of Tech Investment in Latin America, an...

-

23 April 2019

Tencent Invests in Argentina's Mobile App Ualá

Tencent made an undisclosed investment in Ualá, an Argentine mobile...

-

28 March 2019

Ribbit Capital Leads R$25m Investment in Brazil-based Digital Brokerage Warren (em português)

Ribbit Capital led a R$25m investment in Warren, a Brazil-based digital...

-

26 March 2019

QED & Invus Co-Lead US$22.6m Investment in Brazil's Escale

QED Investors and Invus Opportunities co-led a US$22.6m investment in...

-

15 March 2019

a16z & Fifth Wall Ventures Lead US$70m Series B in Brazilian Real Estate Startup Loft (em português)

Brazilian real estate startup Loft raised a US$70m Series B at a valuation...

-

22 January 2019

Advent International Acquires a Majority Stake in Argentina's Prisma for US$725m

Advent International acquired a 51% stake of Prisma Medios de Pago, an...

-

14 January 2019

Mountain Nazca Leads US$7.4m Series A Investment in Albo (en español)

Mountain Nazca led a US$7.4m Series A investment in Albo, a Mexican...

-

30 October 2018

Sequoia Capital Invests US$2.25m in Mexican Startup Rever (en español)

Sequoia Capital and Zetta Venture Partners invested US$2.25m in Rever, a...

-

31 August 2018

Colombia's Rappi Reaches Unicorn Status with US$200m Investment Round Led by DST Global

DST Global led a US$200m investment round in Colombian on-demand delivery...

-

12 July 2018

Movile Raises US$124m for Brazilian On-Demand Food Delivery Company iFood

Movile raised a fresh US$124m round of financing for iFood, led by...

-

11 July 2018

Canary Makes Undisclosed Seed Investment in Brazilian Healthtech Startup Go Good (em português)

Canary made an undisclosed seed investment in Go Good, a collaborative...

-

5 June 2018

Salesforce Ventures Makes Inaugural LatAm Investment in RunaHR

Salesforce Ventures made its inaugural investment in Latin America in...

-

7 May 2018

Inside Latin America's Breakout Year in Tech

Inside Latin America's Breakout Year in Tech is an 8-page graphic report...

-

3 March 2018

Canary Raises R$160m Fund (em português)

Canary raised R$160m for its first fund. Investments include fintech...

-

12 December 2017

Vostok Emerging Finance Leads US$50m Investment in Creditas

Vostok Emerging Finance led a US$50m investment in Creditas (formerly...

-

2 June 2017

KaszeK Ventures Closes US$200m Latin America Tech Focused Fund

Two months after initial fundraising, KaszeK Ventures closed its third...

-

10 December 2016

Scotiabank Partners with QED Investors to Promote FinTech Start-ups in Latin America

(ACN Newswire) Scotiabank and QED Investors announced a partnership to...

-

28 September 2016

Why Have Some of Silicon Valley’s Top Investors Started Investing in Latin America?

LAVCA Director of Venture Strategy, Julie Ruvolo, lays out the venture...

-

29 July 2016

Founders Fund Invests in Brazilian Legal Website Jusbrasil

Founders Fund has made an undisclosed investment in Jusbrasil, a...

-

16 June 2016

BankFacil Receives R$15m Series A (em português)

(Valor Econômico) Brazilian online lending startup BankFacil has received...

-

27 October 2015

Zup Receives Investment from Kaszek Ventures

(Baguete) Zup, a platform that allows the digitization of traditional...

-

20 August 2015

Guia Bolso Attracts R$22m in New Financing

(Valor Econômico) Brazilian fintech startup Guia Bolso has received a...