Search Results

Search results for: "THE LIVE GREEN CO" in All Categories

-

19 August 2020

Endurance Investments and NOA Capital Invest US$1m in Chilean Foodtech The Live Green Co.

Chilean VC fund Endurance Investments and Mexico’s NOA Capital...

-

7 December 2021

CPP Investments and OTPP To Increase Stake in Mexico’s IDEAL

CPP Investments and Ontario Teachers’ Pension Plan Board (OTPP) agreed...

-

25 August 2021

Lineage Logistics, Stonepeak and D1 Capital Invest USD450m in Emergent Cold Latin America

Lineage Logistics, Stonepeak Partners and D1 Capital Partners invested...

-

24 August 2021

Vinci Partners Reaches BRL384m Second Close for Brazil Water and Sewage Services Fund

Vinci Partners reached a BRL384m second close for Vinci Infraestrutura...

-

18 August 2021

Greenoaks and Tencent Lead USD120m Series E+ for Brazilian Proptech QuintoAndar

Greenoaks and Tencent led a USD120m Series E+ for Brazilian proptech...

-

3 July 2021

SK Tarpon and Greenbridge Invest BRL500m in NSTech

Brazil’s SK Tarpon, through Niche Partners, and Greenbridge invested...

-

9 February 2021

General Atlantic Leads US$65m Series A in Mexican Grocery Delivery Platform Jüsto

General Atlantic led a US$65m Series A in Jüsto, a Mexican grocery...

-

22 January 2021

Valor Capital Leads US$5m Seed Round in Corporate Benefits Platform XP Health

Valor Capital led a US$5m seed round in XP Health, a California-based...

-

5 October 2020

SoftBank, DST Global, and Greenoaks Lead Undisclosed Round in Car Resale Kavak

SoftBank, DST Global, and Greenoaks led an undisclosed round in Kavak, a...

-

18 September 2020

Aliansce Invests R$15.5m in Brazilian Vegetable Subscription Startup BeGreen

Brazilian shopping center developer Aliansce invested R$15.5m in BeGreen,...

-

1 August 2020

ACON Investments Acquires Sola de Antequera

ACON Investments has completed the acquisition of a majority stake in Sola...

-

28 March 2020

DILA Capital and Others Lead Undisclosed Series A in Ecuadorian/Colombian Startup, Kushki

DILA Capital led an undisclosed Series A in payments platform Kushki, with...

-

27 February 2020

QED Investors Closes Its Sixth Fund with US$350m in Commitments

QED Investors closed its sixth fund with US$350m in commitments....

-

14 January 2020

Denham Capital Commits US$250m to Ceiba Energy

Private Equity firm Denham Capital, through its international power fund,...

-

5 November 2019

General Atlantic Promotes Martin Escobari to Co-President

Global growth equity firm General Atlantic announced senior leadership...

-

4 September 2019

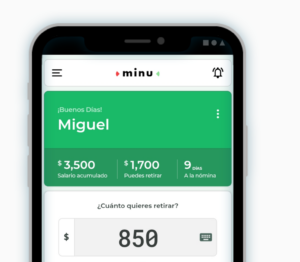

QED Investors, Village Global, Next Billion Ventures, and Mountain Nazca Mexico Invest US$6.5m in minu

minu, a payroll fintech providing Mexican employees digital access to...

-

31 August 2018

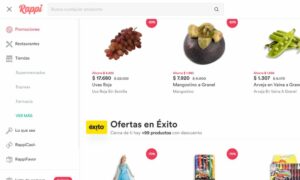

Colombia's Rappi Reaches Unicorn Status with US$200m Investment Round Led by DST Global

DST Global led a US$200m investment round in Colombian on-demand delivery...

-

13 October 2012

The lure of Chilecon Valley

(The Economist) October 13, 2012 – One by one they came to the stage...

-

27 March 2012

Aceco TI Receives Investment from Global Growth Investor General Atlantic

(General Atlantic) March 27, 2012 – Aceco TI, the leading company...

-

30 December 2011

GRUPO SURA Completes Acquisition of ING Assets in LatAm, General Atlantic Enters as Co-Investor

(GRUPO SURA) December 29, 2011 – GRUPO SURA has become the largest...

-

10 June 2020

Sofinnova Partners Leads a US$5.6m Series A in Chilean Biotech Protera

Sofinnova Partners led a US$5.6m Series A in Protera, a Chilean biotech...

-

26 October 2021

Susi Partners to Acquire Renewable Energy Assets in Chile

Susi Partners signed an agreement with BIWO Renovables and Latsolar Energy...

-

26 October 2021

Appian Exits Atlantic Nickel and Mineração Vale Verde via Sale to Sibanye-Stillwater for USD1b

Appian Capital Advisory agreed to sell Brazilian battery metals-focused...

-

28 September 2021

Mexican Lending Platform ProCredito Secures USD6m Private Credit Facility

ProCredito, a Mexican lending platform for SMEs, secured a USD6m private...

-

22 September 2021

Mexican Car Resale Marketplace Kavak Raises USD700m Series E

Mexican car resale marketplace Kavak raised a USD700m Series E led by...

-

18 May 2021

BlackRock Invests in Grupo Axo

BlackRock has made an undisclosed investment in Grupo Axo, a Mexico-based...

-

10 May 2021

OTPP to Acquire Brazilian Electricity Transmission Platform Evoltz From TPG

Ontario Teachers’ Pension Plan (OTTP) has agreed to acquire a 100%...

-

20 April 2021

QED Investors Leads UDD15m Series B for Brazilian Payment Services Provider Hash

QED Investors led a USD15m Series B for Hash, a Brazilian payment services...

-

2 March 2021

CDPQ to Invest BRL1.8b in Joint Venture with Telefónica and Launch FiBrasil

Caisse de dépôt et placement du Québec (CDPQ) and Telefónica Group...

-

27 January 2021

QED Investors Leads US$6m Round in Lending Platform Milo

QED Investors led a US$6m round in Milo, a Colombia- and Miami-based...

-

11 January 2021

Appian Raises US$775m for Appian Natural Resources Fund II

Appian Capital has closed its second fund (“Fund II”) for...

-

19 December 2019

A5 Capital Partners and Inseed Investimentos Form KPTL Fund

A5 Capital Partners and Inseed Investimentos merged to form a new venture...

-

6 September 2019

Ardian and CMB Acquire 33% Stake in Chilean Toll Roads from Brookfield

Ardian and Chilean Fund Manager CMB agreed to acquire a 33% stake in a...

-

5 September 2019

OPIC Invests US$400m in Argentina Toll Road

OPIC announced that its Board of Directors has voted to approve US$400m in...

-

7 March 2019

Omidyar Network Spins Out Fintech Investment Arm as Flourish Ventures

Omidyar Network spun off its financial inclusion investment arm as...

-

13 February 2019

PG Impact Investments Raises US$210m for its First Impact Fund

PG Impact Investments has closed its inaugural social impact fund with...

-

26 November 2018

General Atlantic Invests R$250m in Brazilian Apartment Rental Platform QuintoAndar

General Atlantic invested R$250m in Brazilian apartment rental platform...

-

23 June 2017

Blackstone and Fisterra Energy Announce Financial Closing of Mexican Power Plant

Blackstone’s Fisterra Energy announced the financial closing for the...

-

4 August 2015

Solar Power Startup Bright Raises $US4m to Distribute Energy In The Developing World

(TechCrunch) Bright, a solar panel installation and distribution startup,...

-

15 May 2015

KKR and Monterra Energy Form Joint Venture

(PEHub) KKR and Monterra Energy have launched a joint venture that will...

-

3 July 2012

UCG Investments Launches New Latin American Private Equity Fund

(UCG Investments) July 3rd, 2012 – UCG Investments (“UCGI”), an...

-

16 April 2012

BR Partners Secures Sequoia Stake (em português)

(O Estado de S.Paulo) April 16, 2012 – The private equity arm of...

-

20 March 2012

Argentina’s Keclon Inks Funding for Cleantech Enzymes

(peHUB) March 20, 2012 – Keclon, an Argentina-based emerging innovator...

-

20 December 2011

3i Makes First Investment in Brazil in Blue Interactive Group

(3i) December 20, 2011 – 3i, an international investor focused on...

-

6 May 2011

Brazil’s PeixeUrbano Secures Capital from General Atlantic and Tiger Global

(PeixeUrbano) May 6, 2011 – PeixeUrbano, the first and leading...