Search Results

Search results for: "99" in All Categories

-

7 June 2021

Prosus Ventures and KASZEK Invest USD40m in Last-Mile Delivery 99 Minutos

Prosus Ventures and KASZEK invested USD40m in 99 minutos, a Mexican...

-

9 October 2019

Vinci Partners Acquires Prudenshopping for $199.7m (em português)

Vinci Shopping Centers Real Estate Investment Fund administered by Vinci...

-

7 May 2019

Mexican E-Commerce Platform 99 Minutos Acquires Chilean Startup MuvSmart (en español)

99 Minutos, a Mexican ecommerce shipping platform, acquired MuvSmart, a...

-

4 March 2019

Riverwood Capital’s Blockbuster 99 Deal Receives Top Honor in Latin American Private Equity Awards

-

7 August 2018

Engie Factory Makes Undisclosed Investment in Logistics Startup 99Minutos

Engie Factory made an undisclosed investment in 99Minutos, a last-mile...

-

4 January 2018

Didi Chuxing has agreed to acquire control of Brazil's 99

Didi Chuxing plans to acquire a majority stake in Brazilian rideshare...

-

18 September 2017

Black Creek Group Launches MXN$3.99b CKD (en español)

BCM CKD Management, an affiliate of the Black Creek Group, has listed a...

-

24 May 2017

Japan's Softbank Injects US$100m in 99

Japan’s Softbank and Riverwood Capital bought a minority stake in 99...

-

19 January 2017

Riverwood Capital and DiDi Invest in 99 (em português)

Didi and Riverwood Capital completed an investment in Brazilian car...

-

4 January 2017

Didi Chuxing Leads ~US$100m Investment in 99 (em português)

(Valor Econômico) Chinese transportation giant Didi Chuxing led an...

-

15 August 2016

99 Taxis & Easy Negotiate Merger (em português)

(Baguete) Brazil’s two largest taxi apps, 99 Taxis and Easy, both of...

-

23 December 2015

In Brazil, 99Taxis Start-Up Jockeys to Stay Ahead of Uber

(NYTimes) 99Taxis is raising US$100m, despite economic and political...

-

3 February 2015

99Taxis Receives New Investment (em português)

(Startupi) 99 Táxis receives a new round of investments led by investment...

-

15 January 2015

IMF Investors to Acquire a 24.99% Stake in Conmex from OHL Mexico

(IFM Investors) OHL Mexico, one of the leading groups in the...

-

20 August 2014

Incube Buys 99Motos for R$3m and Relaunches as MovMov.it (em português)

(Startupi) Incube, the investment fund and developer of mobile...

-

27 August 2013

99designs Completes Second Acquisition With Purchase of Leading Brazilian Design Marketplace

(Business Wire) 99designs, the largest online graphic design marketplace...

-

7 May 2024

Q1 2024 LAVCA Industry Data & Analysis

LAVCA’s Industry Data & Analysis is available on a quarterly...

-

26 February 2024

Atmos, Warburg Pincus and Mission Acquire 32% Stake in Brazil’s Grupo Salta Educação

Atmos, Warburg Pincus and Mission acquired a 32% stake in...

-

22 February 2024

Ainda Launches ~USD618m and USD200m Funds in Mexico and Colombia

Private equity investor AINDA Energia &...

-

21 February 2024

Mubadala Acquires Controlling Stake in Brazil’s Zamp

Mubadala acquired a controlling stake in Zamp, the owner of the Burger...

-

14 February 2024

2024 LAVCA Industry Data & Analysis

LAVCA has released its Latin America 2024 Industry Data & Analysis....

-

30 January 2024

GLP Capital Partners Sells 12 Logistical Assets for ~USD304.2m

Alternative asset manager GLP Capital Partners sold its 12 logistics...

-

29 January 2024

SIFEM Invests USD15m in Darby Latin America Fund IV

SIFEM invested USD15m in the fourth Darby Latin America fund focused on...

-

26 January 2024

BTG Pactual Launches Energy Opportunities Fund

BTG Pactual launched its Energy Opportunities fund focused on...

-

22 August 2023

2023 Startup Directory & Ecosystem Insights

LAVCA’s 2023 Startup Directory & Ecosystem Insights profiles 501...

-

21 June 2023

CVC Capital Partners Invests in Brazil’s Delly's

Patria Investimentos’ Private Equity Fund V exited Delly’s, a...

-

20 June 2023

Glisco Partners Reaches First Closes for Real eEstate and Private Equity Funds

Glisco Partners reached a USD100m+ first close towards a USD400m target...

-

20 June 2023

Dalus Capital and Foundation Capital Lead USD10m Seed Round for Mexico’s Clivi

Dalus Capital and Foundation Capital led a USD10m seed round...

-

20 June 2023

Goldman Sachs Partially Exits Brazil’s Oncoclinicas for ~USD187.4m

Goldman Sachs partially exited Oncoclínicas, a Brazil-based...

-

16 June 2023

Colombia’s FinMaq Raises USD23.5m From Undisclosed Investors

FinMaq, a Colombian digital lending platform, raised a USD23.5m round from...

-

14 June 2023

Bicycle Capital Reaches USD440m First Close for Latin America Growth Fund

Bicycle Capital reached a USD440m first close for its first flagship fund...

-

13 June 2023

Valor Capital Group and Quona Capital Lead USD13m Seed Round for Brazil’s Kanastra

Valor Capital Group and Quona Capital led a USD13m seed round...

-

12 June 2023

Appian Capital Advisory Sells Brazil’s Atlantic Nickel and Mineração Vale Verde

Appian Capital Advisory, a Brazil-based mining asset manager, closed an...

-

31 May 2023

GDA Luma Invests USD58m in Colombia’s Credivalores-Crediservicios

GDA Luma made a USD58m investment in Credivalores-Crediservicios, a...

-

31 May 2023

Community Investment Management Provides USD50m Credit Line to Mexico’s Stori

Community Investment Management provided a USD50m credit line to Stori,...

-

12 April 2023

Cometa Leads USD4m Round for Colombia’s Kala

Cometa led a USD4m round for Kala, a Colombian lending infrastructure...

-

27 September 2022

Brazil’s Patria-backed Lavoro To List on Nasdaq via SPAC Merger

(Business Wire (TPB, Lavoro)) Lavoro, a Brazil-based agricultural inputs...

-

20 June 2022

Patria Investments Acquires Brazilian Hydropower Plants from ContourGlobal for BRL1.74b

(Renewables Now) Patria Investments acquired nine run-of-river...

-

23 May 2022

BTG Pactual and Energea Global Sell SPE to Comerc for BRL200m

BTG Pactual and Energea Global agreed to sell a special purpose entity...

-

12 April 2022

ACON Acquires Stake in Brazil’s Sapore

ACON Investments acquired an undisclosed stake in Brazil-based corporate...

-

8 February 2022

MicroVest Invests USD5m in Panama’s Banco La Hipotecaria

MicroVest invested USD5m in Panama-based mortgage lender Banco La...

-

7 February 2022

2022 LAVCA Trends in Tech

Access LAVCA’s 2022 LAVCA Trends in Tech, which breaks down 2021 VC...

-

3 February 2022

Kinea Ventures and G2D Lead USD25m Series A for Brazilian E-Commerce Platform Digibee (em português)

Kinea Ventures and Brazil VC G2D led a USD25m Series A for Digibee, a...

-

29 January 2022

Prisma Capital Increases Stake in Brazil’s Dommo Energia

Prisma Capital increased its stake in Brazil-based oil and gas company...

-

11 January 2022

GIP Lends USD175m to Finance the Construction of a Gas-Fired Power Plant in Panama

Global Infrastructure Partners (GIP) invested USD175m in the form of a...

-

6 January 2022

Generate Capital Invests BRL403m in Brazil’s Conasa

Generate Capital invested BRL403m (~USD71.4m) in Conasa Infraestructura,...

-

22 November 2021

Carlyle to Invest BRL300m in Brazil’s Grupo Madero

The Carlyle Group agreed to invest BRL300m in Brazil-based restaurant...

-

26 October 2021

SoftBank Leads USD75m Series C for Brazilian BPO Platform Pipefy

SoftBank invested USD50m in a USD75m Series C for Pipefy, a Brazilian...

-

22 October 2021

Goldman Sachs Invests in Brazil’s Elea Digital

Goldman Sachs made an undisclosed investment in Elea Digital, a Brazilian...

-

19 October 2021

SoftBank, Amazon and Accel Lead USD108m Series B for Brazilian Fintech Pismo (en español)

SoftBank Latin America, Amazon and Accel led a USD108m Series B for Pismo,...

-

15 October 2021

Bain Capital Acquires 43% Stake in Brazil’s Bionexo

Bain Capital, through Bain Capital Tech Opportunities, invested BRL450m...

-

5 October 2021

Mercado Libre and KASZEK SPAC Raises USD287m In Public Listing

MELI Kaszek Pioneer Corp (MEKA), a SPAC formed by Mercado Libre and...

-

28 September 2021

Advent International and SoftBank Lead USD225m Series B for E-commerce Aggregator Merama

Advent International and SoftBank led a USD225m Series B for Merama, a...

-

13 September 2021

Kinea Ventures Leads ~USD5.4m Series A for Brazilian Credit Consignment Platform Paketá (em português)

Kinea Ventures, the CVC arm of Itaú, led a ~USD5.4m Series A for Paketá,...

-

6 September 2021

Blue like an Orange Invests MXN150m in Mexico’s Alivia

Blue like an Orange Sustainable Capital invested MXN150m in mezzanine...

-

1 September 2021

2021 Latin American Startup Directory

Venture investment has grown dramatically in Latin America since 2016 to...

-

30 August 2021

Trivest Partners Invests in Argentine Fintech Veritran

Trivest Partners, through its Growth Investment Fund II, invested an...

-

30 August 2021

Riverwood Capital Leads USD150m Round for Brazilian Pet Platform Petlove&Co.

Riverwood Capital led a USD150m round for Petlove&Co, a Brazilian...

-

18 August 2021

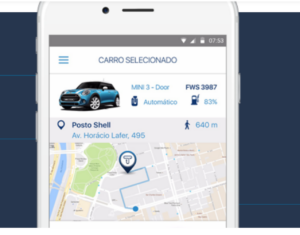

Valor Capital Group and Prosus Ventures Lead USD104m Series B for Brazilian Rental Car Platform Kovi

Valor Capital Group and Prosus Ventures led a USD104m Series B for Kovi, a...

-

11 August 2021

SP Ventures Invests ~USD2.7m in Venture Debt in E-Commerce Solutions Platform Digibee (em português)

SP Ventures invested ~USD2.7m in venture debt in Digibee, an e-commerce...

-

26 July 2021

Gávea Partially Exits Brazil’s Armac via BRL1.5b IPO (em português)

Gávea Investimentos’ Speed fund partially exited Armac, a Brazilian...

-

26 July 2021

Stonepeak to Acquire Lumen's Latin American Business for USD2.7b

Stonepeak agreed to acquire the Latin American operations of Lumen...

-

21 July 2021

Tiger Global and Insight Partners Lead USD50m Series C for Visual Collaboration Platform MURAL

Tiger Global and Insight Partners led a USD50m Series C for for Mural, a...

-

21 July 2021

Valor Capital Group Leads USD3.6m Round for Corporate Benefits Platform Quansa

Valor Capital Group led a USD3.6m round for Quansa, a Chile- and...

-

20 July 2021

Insight Partners and Tiger Global Lead USD50m Series C for Visual Collaboration Platform MURAL

Insight Partners and Tiger Global led a USD50m Series C for MURAL, a...

-

19 July 2021

GIC Acquires Minority stake in Aqua Capital-backed Biotrop

GIC acquired a significant minority stake in Aqua Capital-backed...

-

16 July 2021

KKR to Invest ~USD500m in Telefónica Colombia to Create First Open Access Fiber Optic Network

KKR agreed to invest ~USD500m in Telefónica Colombia, a subsidiary of...

-

14 July 2021

Imaginable Futures Leads ~USD3.1m Round for Brazilian Edtech Arvore (em português)

Imaginable Futures led a ~USD3.1m round for Árvore, a Brazilian digital...

-

13 July 2021

WE Ventures Invested ~USD1.1m in Brazilian Marketing Intelligence Platform Mobees (em português)

We Ventures invested ~USD1.1m in Mobees, a Brazilian marketing...

-

13 July 2021

Kandeo Exits Finsocial Via Sale to International Investors (en español)

Colombia’s Kandeo exited Finsocial, a Colombia-based fintech focused...

-

6 July 2021

ACON Exits Brazil’s Conexão via Sale to Grain Management

Acon Investments, through its Latin America Opportunities Fund IV,...

-

3 July 2021

SK Tarpon and Greenbridge Invest BRL500m in NSTech

Brazil’s SK Tarpon, through Niche Partners, and Greenbridge invested...

-

2 July 2021

Dasa Acquires H.I.G. Capital-backed Clínica AMO for BRL750m

Ímpar Serviços Hospitalares (DASA) acquired H.I.G. Capital-backed...

-

2 July 2021

Canary Leads USD1.4m Round for Brazilian Subscription Management Platform Lastlink (em português)

Canary led a USD1.4m round for Lastlink, a Brazilian community and...

-

30 June 2021

Lucens Capital Acquires Summum Energy

Lucens Capital acquired Summum Energy, an oilfield services company in...

-

29 June 2021

IDB Invest, Blue Like an Orange and Mexico Ventures Lead USD27.5m Round in Mexican Lending Platform kubo.financiero (en español)

IDB Invest, Blue Like an Orange and Mexico Ventures led a USD27.5m round...

-

19 June 2021

IDB Invest Provides a USD14m Loan to Costa Rica’s Calox

IDB Invest provided a USD14m loan to Costa Rica’s pharmaceutical company...

-

18 June 2021

monashees Leads ~USD8m Round for Beauty Salon Platform Gal (em português)

monashees led a ~USD8m round for Gal, a Brazilian finance, marketing and...

-

7 June 2021

Kinea Exits Centro Clínico Gaúcho (CCG) via BRL1.06b Sale to Notre Dame Intermédica (em português)

Kinea Investimentos exited health provider Centro Clínico Gaúcho (CCG)...

-

2 June 2021

Enlightened Hospitality Investments Invests in Chilean Foodtech NotCo

Enlightened Hospitality Investments invested in Chilean foodtech NotCo....

-

1 June 2021

ACON Investments Acquires Vitalis Group

ACON Investments, through its Latin America Opportunities Fund V,...

-

18 May 2021

Advent International to Acquire Perrigo’s Pharmaceutical Operations in Mexico

Advent International has agreed to acquire the Latin American operations...

-

18 May 2021

BlackRock Invests in Grupo Axo

BlackRock has made an undisclosed investment in Grupo Axo, a Mexico-based...

-

18 May 2021

Minerva Foods and Quartz Lead BRL120m Series B for Brazilian Delivery Platform Shopper (em português)

Brazilian beef exporter Minerva Foods and Quartz led a BRL120m Series B...

-

10 May 2021

LIV Capital SPAC to Merge with Nexxus Capital-Backed AgileThought

LIV Capital SPAC has agreed to merge with Nexxus Capital-backed...

-

10 May 2021

OTPP to Acquire Brazilian Electricity Transmission Platform Evoltz From TPG

Ontario Teachers’ Pension Plan (OTTP) has agreed to acquire a 100%...

-

5 May 2021

Riverwood Capital Invests in SUMA

Riverwood Capital made an undisclosed follow-on investment in SUMA, a...

-

27 April 2021

Nexus Chile Acquires 100% Stake in Colmena Salud (en español)

Nexus Chile, a firm backed by US-based private equity fund Nexus Partners,...

-

19 April 2021

Oria Capital and Riverwood Exit Mandic via Sale to Claranet (em português)

Riverwood Capital and Oria Capital partially exited cloud and...

-

6 April 2021

Aqua Capital Acquires Rech Tratores for ~BRL100m (em português)

Aqua Capital has agreed to acquired Rech Tratores, a Brazil-based reseller...

-

5 April 2021

KKR Acquires 20% in Sempra Infrastructure Partners for USD3.4b

KKR has acquired a 20% stake in Sempra Infrastructure Partners for...

-

24 March 2021

Carrefour to Acquire Advent-backed Grupo BIG for BRL7b

Grupo Carrefour Brasil has agreed to acquire Grupo BIG Brasil, a...

-

16 March 2021

Aurea Ventures Purchases USD7.5m Stake and Chile Country Rights for US-Based Marketplace HUMBL

Chilean multifamily office Aurea Ventures purchased a USD7.5m stake in...

-

12 March 2021

Cerberus Acquires 39.2% Stake in Brasil Brokers (em português)

Cerberus has acquired 39.2% stake in real estate investment company Brasil...

-

22 February 2021

KKR to Acquire Majority Stake in Telefonica Chile’s Fiber Optic Network in a Deal Valued at US$1b

KKR has agreed to acquire a majority stake in the existing fiber optic...

-

12 February 2021

H.I.G. Capital in Partial Exit from Brazilian Advertising Company Eletromidia via IPO for US$17m (em português)

H.I.G. Capital has partially exited its stake in Brazil-based outdoor...

-

11 February 2021

H.I.G. Capital Acquires Brasília Indústria e Comércio de Alimentos FVO

H.I.G. Capital has acquired pet food manufacturer FVO – Brasília...

-

11 February 2021

ThornTree Capital Partners Leads R$180m Series B in Brazilian Healthcare Provider Alice (em português)

ThornTree Capital Partners led a R$180m Series B round in Brazilian...

-

10 February 2021

SoftBank and Invus Opportunities Lead US$84.5m Round in Brazilian Edtech Descomplica

SoftBank and Invus Opportunities led a US$84.5m round in Brazilian edtech...

-

5 February 2021

Women's World Banking Capital Partners Leads US$6.6m Convertible Debt Round in Aflore (en español)

Women’s World Banking Capital Partners led a US$6.6m convertible debt...

-

27 January 2021

Sequoia Capital Exits Pindaí via Sale to Electrobras for R$20.6m (em português)

Sequoia Capital has exited wind complex Pindaí via a sale to Electrobras...

-

15 January 2021

Alloy Merchant Finance Completes Undisclosed Debt Investment in Moneta Technologies

Alloy Merchant Finance has completed an undisclosed debt investment into...

-

11 January 2021

DHS Private Equity Trust Acquires Grupo VITRO for US$1.2b

DHS Private Equity Trust has acquired Mexican glass and beverage producer...

-

22 December 2020

H.I.G. Capital Invests in KM2 Solutions

H.I.G. Capital invested an undisclosed amount in KM2 Solutions, business...

-

7 December 2020

PC Capital and Altum Capital Complete Undisclosed Investment in Medios Cattri

Mexican private equity firm PC Capital and Mexican private credit fund...

-

6 December 2020

Riverwood Capital Invests US$32m in Brazilian Freight Management Intelipost

Riverwood Capital invested US$32m in Intelipost, a Brazilian freight...

-

24 November 2020

H.I.G. Capital Acquires Brazilian Internet Service Provider Desktop Sigmanet

H.I.G. Capital has acquired Brazil-based internet service provider Desktop...

-

30 October 2020

Viking Global Investors Leads US$150m Round in Brazilian Card Issuer Conductor

US-based hedge fund Viking Global Investors led a US$150m round in...

-

20 October 2020

Valor Capital and monashees Lead R$86m Series A in Brazilian Healthtech Sami

Valor Capital and monashees led a R$86m Series A in Sami, a Brazilian...

-

9 October 2020

Capria Ventures Invests US$1m in Argentine Agtech Marketplace Agrofy (en español)

Capria Ventures invested US$1m in Agrofy, an Argentine marketplace for...

-

7 October 2020

Warburg Pincus Invests US$100m Series A for Brazilian API Communication Platform Take Blip

Warburg Pincus has invested a US$100m Series A for Brazil-based API...

-

6 October 2020

FTV Capital Makes US$42.5m Minority Investment in Lean Staffing Solutions

FTV Capital made a US$42.5m minority investment in Lean Staffing...

-

5 October 2020

Riverwood Capital Leads R$50m Series B Extension for Marketing and Sales Startup Cortex (em português)

Riverwood Capital invested R$50m in a Series B extension in Cortex, a...

-

1 October 2020

Advent Enters Strategic Partnership with Brazilian Chocolate Producer Grupo CRM

Advent International has entered a strategic partnership with Brazil-based...

-

29 September 2020

Advent International Raises US$2b for LAPEF VII Fund

Advent International has raised a US$2b final close for Advent Latin...

-

25 September 2020

BID Invest Grants US$60m Line of Credit to Mexican Lending Platform Konfio (en español)

BID Invest granted a line of credit of up to ~US$60m to Mexican lending...

-

21 September 2020

General Atlantic and SoftBank Lead US$108m Series B in Acesso Digital

General Atlantic and SoftBank’s Latin America Fund led a US$108m Series...

-

11 September 2020

Advent Exits Brazilian Investment Platform Easynvest and Invests in Nubank

Advent International has agreed to sell its stake in Brazil-based digital...

-

9 September 2020

Vinci Partners Invests R$400m in Brazilian Digital Bank Agibank (em português)

Vinci Partners has acquired a minority stake in Brazil-based digital bank...

-

8 September 2020

ACON-Backed CryoHoldco Acquires Cordcell (en español)

ACON-backed CryoHoldco, a Mexico-based technology company,...

-

5 September 2020

Redpoint eventures Leads R$10m Series A in Brazilian Clothing Resale Marketplace Repassa (em português)

Redpoint eventures led a R$10m Series A in Repassa, a Brazilian clothing...

-

3 September 2020

AMP Capital and Enel Group Create Joint Venture for Public Transportation Infrastructure

AMP Capital and Enel X created joint venture for public transportation and...

-

25 August 2020

Insight Partners Leads US$118m Series B in Visual Collaboration Platform MURAL

Insight Partners led a US$118m Series B in MURAL, a US-based visual...

-

24 August 2020

Carlyle-Backed COG Energy Purchases ARROW Exploration's LLA 23 Block for US$12m

Carlyle-backed oil and gas exploration and production company COG Energy...

-

19 August 2020

EB Capital Acquires Stake in Mob Telecom

Brazil-based EB Capital has acquired a controlling stake in Mob Telecom, a...

-

6 August 2020

Canary and Valor Capital Lead R$13m Round in Employee Benefits Management Platform Caju

Canary and Valor Capital led a R$13m round in Caju, a Brazilian employee...

-

6 August 2020

Advent to Exit Brazilian Home Improvement Retailer Quero-Quero via IPO for up to R$1.9b

Advent International has agreed to sell its 88% stake in Brazil-based home...

-

1 August 2020

ACON Investments Acquires Sola de Antequera

ACON Investments has completed the acquisition of a majority stake in Sola...

-

20 July 2020

Brookfield Gets Additional US$32.3m for Exit of EBSA to Northland Power

Brookfield Asset Management received an additional US$32.3m for the sale...

-

14 July 2020

SVB Launches US$30m Latin America Growth Debt Fund

SVB launched a US$30m Latin America Growth Lending Fund in partnership...

-

7 July 2020

Bocel to Launch CKD (en español)

Private equity fund Bocel will launch a CKD on the Mexican Stock Exchange...

-

3 July 2020

IDB Lab Invests an Undisclosed Amount in DILA Capital's DILA IV Fund

IDB Lab announced an undisclosed investment in DILA Capital’s DILA IV...

-

1 July 2020

Canary, KaszeK Ventures, and MAYA Capital Invest US$16m in Alice

Canary, KaszeK Ventures, and MAYA Capital invested US$16m in Alice, a...

-

30 June 2020

Mountain Nazca and Foundation Capital Lead a US$12m Bridge Round in Grocery Delivery Startup Jüsto

Mountain Nazca and Foundation Capital led a US$12m follow-on investment in...

-

22 June 2020

Global Founders Capital, ONEVC, and Flourish Ventures Invest in Brazilian Fintech Swap

Global Founders Capital, ONEVC, and Flourish Ventures made an undisclosed...

-

8 June 2020

Canary Leads a R$3m Round in Brazilian Rental Platform Boomerang (em português)

Canary led a R$3m round in Boomerang, a Brazilian consumer goods rental...

-

6 May 2020

Canary, Atlantico, and Big Bets Lead a R$7.5m Round in Festalab

Canary, Atlantico, and Big Bets led a R$7.5m round in Brazilian event...

-

16 April 2020

CPPIB and OTPP Finalize Purchase of 40% Stake in Mexican Infrastructure Operator IDEAL

Canada Pension Plan Investment Board (CPPIB) and Ontario Teachers’...

-

14 April 2020

Evolvere Capital Acquires Dental Clinic Network Dentix Colombia (en español)

Private equity firm Evolvere Capital has acquired Colombia-based dental...

-

7 April 2020

SoftBank Invests US$48m in Petlove

SoftBank has invested US$48m from its Latin America fund in Brazil-based...

-

6 April 2020

H.I.G. Capital Leads US$65m Investment in Modern Logistics

H.I.G. Capital led a US$65m investment in Brazil-based full service...

-

26 March 2020

Capital Invent Fund Leads US$1.4m Pre A Series Round in Dev.f

Capital Invent led a MX$27.6m round in Dev.f, a Mexican edtech for...

-

3 March 2020

OLX Brazil Backed by Naspers to Acquire Grupo ZAP for US$642m

OLX, a global classifieds marketplace backed by Naspers, has made a...

-

1 March 2020

Alta Growth Capital Sells Stakes in Three Mexican Hospitals to RAG Capital Partners for US$6.2m

Mexican private equity fund manager Alta Growth Capital has sold 50% of...

-

14 February 2020

KaszeK Ventures, ONEVC, and Valor Capital Lead Investment in Docket (em português)

Docket, a Brazilian document management platform, raised R$35m over two...

-

12 February 2020

Darby Completes Debt Investment in Mexican Blueberry Producer Bloom Farms

Darby, emerging market private capital arm of Franklin Templeton, has...

-

10 February 2020

Advent International Completes Sale of Stake in OCENSA to I Squared Capital

Advent International completed the sale of stake in OCENSA, a Colombian...

-

30 January 2020

Grupo IGS Acquires South Park Complex in Mexico (en español)

Grupo IGS acquired the South Park Complex in Mexico. The amount of the...

-

17 January 2020

Promecap Launches Third CKD for US$320m Mexican Stock Exchange (en español)

Mexico’s Promecap Capital launched its third CKD for US$320m on the...

-

14 January 2020

ABseed and Order Invest R$10m in Leads2b (em português)

ABseed and Order invested R$10m in Leads2b, a Brazilian client prospecting...

-

27 December 2019

GEF Capital Partners Exits AGV Logística Saúde By Selling to FEMSA-Solistica

GEF Capital Partners exited AGV Logística Saúde through a sale to...

-

19 December 2019

A5 Capital Partners and Inseed Investimentos Form KPTL Fund

A5 Capital Partners and Inseed Investimentos merged to form a new venture...

-

18 December 2019

Qualcomm and BNDES Invest R$80m in Brazilian IoT Projects (em português)

Qualcomm Ventures and BNDES launched a R$160m fund to invest in IoT...

-

5 December 2019

monashees, Valor Capital, and Canary Invest R$38m in Mimic (em português)

monashees, Valor Capital, and Canary invested R$38m in Mimic, a Brazilian...

-

1 December 2019

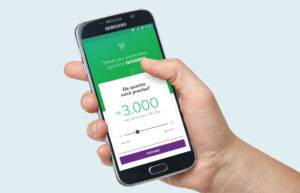

monashees and Fintech Collective Leads a US$10m Investment in Rebel

monashees and Fintech Collective led a US$10m investment in Brazilian...

-

26 November 2019

Former Actis Partner Joins XP to Launch PE Fund

Chu Kong a former partner at Actis joined XP Investimentos to aid in their...

-

26 November 2019

CPPIB Acquires Stake in Smart Fit for R$1.07b

CPPIB took a 12.4% stake in Brazilian gym chain Smart Fit for R$1.07b....

-

22 November 2019

SoftBank Leads a US$140m Investment in VTEX

SoftBank led a US$140m investment in VTEX, a Brazilian ecommerce SaaS...

-

21 November 2019

CPPIB and Ontario Teachers' Pension Plan to Acquire 40% Stake in IDEAL

Canada Pension Plan Investment Board (“CPPIB”) and Ontario...

-

14 November 2019

Finsa to Launch its 3rd CKD on the Mexican Stock Exchange (en español)

Mexican industrial real estate developer Finsa plans to launch its third...

-

14 November 2019

Walton Street Capital and Fibra Uno Acquire 74 Industrial Buildings for US$841m (en español)

Walton Street Capital investment fund and Fibra Uno acquired a portfolio...

-

12 November 2019

2019 Latin American Startup Directory

In recent years, Latin America has produced a growing cohort of startups...

-

6 November 2019

L Catterton Invests in OdontoCompany

L Catterton completed a strategic investment into dental company...

-

5 November 2019

Stratus Group's BBM Logística Acquires Translovato

BBM Logística, a distribution and logistics portfolio company of the...

-

5 November 2019

Global Founders Capital Leads a US$30m Investment in Kovi

Global Founders Capital led a US$30m investment in Kovi, a Brazilian...

-

5 November 2019

General Atlantic Promotes Martin Escobari to Co-President

Global growth equity firm General Atlantic announced senior leadership...

-

30 October 2019

Anacapa Partners Invests in Auronix

US based private equity firm Anacapa Partners completed a growth...

-

23 October 2019

Qualcomm Ventures Leads a R$40m investment in idwall (em português)

Qualcomm Ventures led a R$40m investment in idwall, a Brazilian validation...

-

7 October 2019

SoftBank Latin America Fund and Grupo Globo Invest in Buser

Brazilian bus ticketing platform Buser raised an undisclosed round from...

-

20 September 2019

Redpoint eventures, Diego Gomes, Renato Freitas, and Pedro Sirotsky Invest R$1.6m in BossaBox (em português)

Brazilian HRtech BossaBox raised a R$1.6m seed round from Redpoint...

-

17 September 2019

CCR Invests US$10m in Quicko (em português)

Quicko, a Brazilian smart mobility startup working on commuter transit,...

-

14 September 2019

SoftBank Invests Again in Banco Inter

SoftBank is doubling down on its investment in Banco Inter, a publicly...

-

10 September 2019

Brookfield Infrastructure Sells Colombian Utility EBSA for C$1.05b

Northland Power has acquired a 99.2% interest in Empresa de Energía de...

-

3 September 2019

H.I.G. Capital Completes Acquisition of Nadir Figueiredo

H.I.G. Capital completed the acquisition of Nadir Figueiredo Indústria e...

-

29 August 2019

Goldman Sachs, Point72 Ventures, and Others, Invest US$42m in Credijusto

Credijusto, a fintech startup that provides affordable financing to SMEs...

-

29 August 2019

KaszeK Ventures Raises US$600m Across Two New Funds

KaszeK Ventures raised US$600m across two new funds, including US$375m for...

-

22 August 2019

Stanley Black & Decker Invests in Argentina's Iguanafix

Iguanafix, an Argentine marketplace for home improvement services, raised...

-

15 August 2019

Riverwood Capital Leads a US$50m Series D Investment in Resultados Digitais (RD Station)

Riverwood Capital led a US$50m Series D investment in Resultados Digitais,...

-

13 August 2019

Blue Water Exits Peruvian Electricity Provider Electro Dunas Energía

Private equity firm Blue Water Advisors fully exited Peruvian electricity...

-

7 August 2019

KaszeK Ventures and SoftBank Invest R$70m in Volanty

KaszeK Ventures and SoftBank led a R$70m (US$17.6m) round in Brazilian...

-

30 July 2019

BR Malls Acquires Additional 25.5% Stake in Shopping Iguatemi Caxias do Sul (em português)

BR Malls acquired an additional 25.5% stake in Shopping Iguatemi Caxias do...

-

30 July 2019

Canary Leads R$10m Investment in Shopper (em português)

Shopper, a Brazilian subscription delivery platform for consumer products,...

-

29 July 2019

Advent Invests in CI&T

Advent International will invest an undisclosed amount into Campinas,...

-

29 July 2019

Softbank Acquires ~R$1b in Shares of Banco Inter (em português)

SoftBank acquired ~R$1b in shares of Banco Inter, a publicly traded...

-

19 July 2019

FINEP and Others Invest R$4m in ChoppUp (em português)

ChoppUp, a Brazilian IoT startup that partners with beer distributors,...

-

17 July 2019

Abu Dhabi Investment Authority (ADIA) to Invest in Latin America

Abu Dhabi Investment Authority (ADIA)’s real estate team stated that...

-

11 July 2019

Nexus Group Sells Stake in InRetail Peru for US$240m (en español)

Peruvian private equity firm Nexus Group sold its 6.3% stake in InRetail...

-

7 July 2019

Paladin Realty Partners To List a CERPI For MXN$4b on the BMV (en español)

Real Estate investor Paladin Realty Partners is preparing to list a CERPI...

-

30 June 2019

Yellowstone Capital Partners Closes US$300m for Colombia Real Estate Fund II

Colombian private equity real estate firm Yellowstone Capital Partners has...

-

28 June 2019

Southern Cross Group and Riverstone Invest US$160m in Aleph (en español)

Southern Cross Group and Riverstone announced plans to jointly invest...

-

25 June 2019

Ivanhoé Cambridge and Citibanamex Afore Invest US$313m in Gran Ciudad

Gran Ciudad closed a Real Estate Fund of US$313m with commitments from...

-

19 June 2019

Bulb Capital Invests US$7m in Amaro

Swiss VC Bulb Capital invested US$7m in Brazilian direct-to-consumer...

-

11 June 2019

Andreessen Horowitz and Others Invest US$12.5m in ADDI

Andreessen Horowitz invested US$12.5m in ADDI, a Colombian point-of-sale...

-

28 May 2019

ODATA Launches its First Data Center in Colombia

Real Estate Investment Trust Company CyrusOne helped Brazilian data center...

-

20 May 2019

Sapphire Ventures Leads a US$103m Series E Investment in Auth0

Sapphire Ventures led a US$103m Series E investment in Auth0, a US-based...

-

15 May 2019

CDPQ Acquires 45% stake in DP World Chile

CDPQ through its investment partnership with DP World acquired a 45% stake...

-

15 May 2019

Monashees Leads US$10.5m Seed Investment in Rental Car Provider Kovi (em português)

Monashees led a US$10.5m seed investment in Kovi ,provider of rental cars...

-

10 May 2019

DILA Capital and Mountain Nazca Mexico Exit Creze (en español)

DILA Capital and Mountain Nazca Mexico exited Creze, a Mexican financial...

-

7 May 2019

Portuguese VC Indico Capital Partners Invests in Zenklub (em português)

Portuguese VC Indico Capital Partners made its inaugural Brazil investment...

-

7 May 2019

General Atlantic-Backed Arco Educação Acquires Positivo (em português)

Brazilian education company Arco Educação acquired Positivo, an...

-

7 May 2019

Google AI Impact Challenge Invests US$750k grant in Brazilian App Hand Talk

HandTalk, a real-time translation platform for Brazilian sign language,...

-

25 April 2019

Horácio Lafer Piva & other Angels Invest US$5m in Brain4care (em português)

Brazilian medical device startup brain4care (formerly Braincare) raised...

-

18 April 2019

Advent Prepares to Launch US$2.2b Latam Focused Fund

Advent International is preparing a new fund focused on Latin American...

-

29 March 2019

FIS Ameris Invests in Chile's Kirón (en español)

FIS Ameris made an undisclosed investment in Kirón, a Chilean medical...

-

25 March 2019

Nilo Ventures Invests in Peruvian Visual Identity Platform Keynua

Nilo Ventures made an undisclosed investment in Keynua, a Peruvian visual...

-

25 March 2019

Alta Growth Capital Exits Fruehauf with Sale to Fultra

Mexican private equity fund manager Alta Growth Capital has announced the...

-

20 March 2019

I Squared Capital Exits Jamaica Private Power Company (JPPC) in Sale to Inter-Energy Group

Global infrastructure investment manager I Squared Capital has exited...

-

13 March 2019

Softbank Leads US$1.2m Investment in Colombian Hotel Chain Ayenda Rooms (en español)

SoftBank leads a US$1.2m investment in Ayenda Rooms, a Colombian hotel...

-

10 March 2019

Starboard in Talks to Buy Ten Onshore Oil Fields from Petrobras for R$1b (em português)

Alternative investment management firm Starboard Restructuring Partners is...

-

7 March 2019

Softbank Announces US$5b Fund for Latin American Tech

SoftBank announced an initial US$2b commitment on a new SoftBank...

-

7 March 2019

Omidyar Network Spins Out Fintech Investment Arm as Flourish Ventures

Omidyar Network spun off its financial inclusion investment arm as...

-

14 February 2019

L Catterton Acquires Argentine Winery Susana Bello Wines (en español)

Private equity firm L Catterton acquired Argentina-based winery Susana...

-

14 February 2019

Portland Private Equity Leads US$14m in Merqueo

Portland Private Equity led a US$14m investment in Merqueo, a Colombian...

-

12 February 2019

IDB Invest & Orange Sustainable Capital Announce US$70m in Financing for Cabify

Cabify secured US$70m in structured financing from IDB Invest and Blue...

-

7 February 2019

MDFI Launches Private Equity Impact Fund for Independent Media

Media Development Investment Fund (MDFI) has announced the closing of...

-

31 January 2019

SoftBank Plans to Launch Latam Fund with Potential to Reach US$1b+

SoftBank is preparing a Latin American fund that “could reach several...

-

30 January 2019

Mexican Private Equity Firm Nexxus Capital Announces New Directors

Nexxus Capital announced that, effective January 1st, 2019; Iker Paullada...

-

25 January 2019

SoftBank to Lead US$190m+ Investment in Brazil's Gympass (em português)

#UNICORNS SoftBank will lead a US$190m (and up to US$500m) investment in...

-

23 January 2019

Abraaj Group’s Private Equity Platform in Latin America to be Acquired by Colony Capital

The Abraaj Group and Colony Capital, a global investment firm, have signed...

-

22 January 2019

NH Securities Invests R$327m in Brazil's Venture Capital Investimentos (em português)

NH Securities invests R$327M in Venture Capital Investimentos, a Brazilian...

-

27 December 2018

Private Equity Fund Aqua Acquires a Majority Stake in Colombian Financial Services Company Dann Regional (en español)

Private Equity Fund Aqua, managed by Renta4Global, acquired a 51% stake in...

-

27 December 2018

Lone Star Acquires Argentina-based San Antonio Internacional for Close to US$150m (en español)

Dallas-based private equity firm Lone Star has acquired San Antonio...

-

3 December 2018

Sigma Safi Sells US$250M Bond to Refinance & Acquires Two Peruvian Wind Farms

Sigma Safi sold a US$250m bond through co-issuers Parque Eólico Marcona...

-

3 December 2018

Discovery Americas Invests in Mexican Air Freight Service Company Mas Air

Mexican private equity firm Discovery Americas has signed an agreement to...

-

27 November 2018

H.I.G. Signs Agreement with Tecnisa for 2019 Launch

Tecnisa, a Brazilian residential property manager, announced a joint...

-

20 November 2018

500 Startups Invests US$60k in Colombia's Globalwork (en español)

500 Startups invested US$60k in Globalwork, a Colombian enterprise hiring...

-

13 November 2018

H.I.G. Portfolio Company Grupo Meridional Acquires Hospital Metropolitano in Brazil

H.I.G. Capital announced that its portfolio company, Grupo Meridional,...

-

7 November 2018

monashees Closes US$150m 8th Fund for Investment in Latin America

monashees closed its seventh VC fund, a US$150m vehicle, with...

-

31 October 2018

Alta Growth Capital Makes Undisclosed Investment in Mexican Independent Leasing Company Docuformas

Alta Growth Capital made an undisclosed investment to acquire an equity...

-

30 October 2018

Darby Closes US$300m Latin American Debt Fund

Darby Overseas Investments announced the final close of its Darby Latin...

-

23 October 2018

Visa Makes First Brazil Investment in Payments Processing Platform Conductor

Visa made its first investment in Brazil in Conductor, a payments...

-

22 October 2018

Paladin Exits Viver in Sale to Jive (em português)

Viver Incorporadora announced a corporate restructuring in which it will...

-

19 October 2018

CPPIB & Votorantim Energia Invest R$1.7b in Brazilian Hydropower Company Companhia Energética de São Paulo (CESP)

The Canada Pension Plan Investment Board (CPPIB) and Votorantim Energia...

-

19 October 2018

Axxon Group Acquires Home Decorating e-Commerce Company Westwing (em português)

The Axxon Group, a private equity fund manager based in Rio de Janeiro,...

-

11 October 2018

Family Office Leads R$5m Investment in Brazilian E-Commerce Locker Startup Alfred (em português)

The Gontijo family office led a R$5m investment in Alfred, a Brazilian...

-

10 October 2018

Dux Capital Makes Undisclosed Investment in Transcription Startup Atexto (en español)

Dux Capital made an undisclosed investment in transcription startup...

-

8 October 2018

CyrusOne Invests US$12m in Patria Investments' ODATA Brasil and ODATA Colombia

CyrusOne, a global data center REIT, announced it will make a US$12m...

-

3 October 2018

H.I.G. Capital Acquires Brazilian Automotive Filters Producer Tecfil

H.I.G. Capital acquired Tecfil, a Brazilian automotive filters producer...

-

2 October 2018

IDEAL, CPPIB and Ontario Teachers Invest in Pacifico Sur Toll Road in Mexico

Impulsora del Desarrollo y el Empleo en América Latina (IDEAL), CPPIB and...

-

1 October 2018

Domo Invest Leads R$4m Investment in Brazilian Car-Sharing Platform Turbi (em português)

Domo Invest led a R$4m investment in Turbi, a Brazilian car-sharing...

-

25 September 2018

Cedro Capital Invests R$6m in Risk Management Platform Gira (em português)

Cedro Capital invested R$6m in Gira, a risk management platform for...

-

20 September 2018

GTIS Partners is GRESB Top Sustainable Private Equity Real Estate Investment Fund

GITS Brazil Real Estate Fund has been awarded the top ranking most...

-

18 September 2018

Atlas Renewable Energy Acquires Four Sun Power Solar Parks in Mexico (en español)

Atlas Renewable Energy entered into three share purchase agreements for...

-

17 September 2018

EIG Manabi Acquires Shares of Classroom Investments in MLog (en español)

EIG Manabi Holdings acquired shares of Canadian investment management firm...

-

13 September 2018

GGV Capital Leads US$63m Series A in Brazilian Mobility Startup Yellow

GGV Capital led a US$63m Series A in Yellow, a Brazilian dockless bike...

-

11 September 2018

H.I.G. Capital Makes Undisclosed Investment in Clínica AMO

H.I.G. Capital announced that one of its affiliates has completed a...

-

31 August 2018

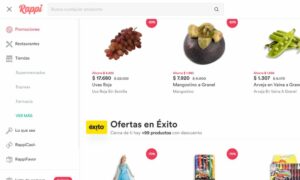

Colombia's Rappi Reaches Unicorn Status with US$200m Investment Round Led by DST Global

DST Global led a US$200m investment round in Colombian on-demand delivery...

-

7 August 2018

HIG Capital’s Symplicity Acquires Brazilian HR Platform Contratanet

HIG Capital's portfolio company, Symplicity Corporation, announced the...

-

1 August 2018

Advent International Closes Investment in 80% Equity Stake in Walmart Brazil

Advent International has announced the closing of its investment in an 80%...

-

20 July 2018

Y Combinator Backs LatAm Focused e-Scooter Startup Grin

monashees+, Sinai Ventures, Liquid2 Ventures, 500 Startups, Base10...

-

12 July 2018

Movile Raises US$124m for Brazilian On-Demand Food Delivery Company iFood

Movile raised a fresh US$124m round of financing for iFood, led by...

-

11 July 2018

Canary Makes Undisclosed Seed Investment in Brazilian Healthtech Startup Go Good (em português)

Canary made an undisclosed seed investment in Go Good, a collaborative...

-

11 July 2018

ACON Sells Hidrotenencias to Glenfarne

ACON announced that its third Latin American-focused private equity fund,...

-

26 June 2018

monashees+ and Qualcomm Ventures Make a R$14.7m Investment in Brazil's Hi Technologies (em português)

monashees+ and Qualcomm Ventures made a R$14.7m investment in Hi...

-

21 June 2018

Paladin Realty Adds Investment Manager Alvaro Rodgriguez to Mexico City Team

Paladin Realty, LLC, announced that it has hired Alvaro Rodriguez to join...

-

20 June 2018

Abraaj Holdings, Abraaj Investment Management, and Colony Capital Successfully Agree on Transaction

Abraaj Holdings, Abraaj Investment Management (together "the Group"), and...

-

12 June 2018

Canary Makes R$1m Investment in Brazilian Beauty Salon Management Platform LaPag (em português)

Canary made a R$1m investment in LaPag, a Brazilian beauty salon...

-

8 June 2018

Bzplan and FIR Capital Make R$3m Investment in Brazilian Marketing Startup PhoneTrack

Bzplan and FIR Capital made a R$3m investment in PhoneTrack, a Brazilian...

-

7 June 2018

ACON Investments and Humus Capital Acquire Argentina’s Biosidus

ACON Investments in partnership with Humus Capital Partners have acquired...

-

6 June 2018

Oikocredit, MicroVest, and Triodos Sell Stakes in Banco Solidario

Oikocredit, MicroVest Capital Management and Triodos Investment Management...

-

6 June 2018

Grupo IGS To Purchase Mexican Industrial Portfolio Frontera (en español)

Real estate developer and fund manager Grupo IGS is set to purchase a...

-

4 June 2018

Advent International to Acquire Majority Stake in Walmart Brazil

Advent International will acquire a majority stake in Walmart Brazil. ...

-

31 May 2018

Wharton Alumni Angels Seeks to Invest in Brazilian American Startups (em português)

Wharton Alumni Angels’ Brazil Chapter is looking to invest R$9-12m in...

-

24 May 2018

Visa Leads US$12.5m Investment in Fintech YellowPepper

Visa led a US$12.5m strategic investment in Latin American fintech pioneer...

-

22 May 2018

responsAbility Investments AG Exits Peru’s Microfinance Provider Mibanco

responsAbility Investments, a leading investor in the field of development...

-

22 May 2018

Parallell18 Ventures Invests in Fintech and Insurance Startups from Puerto Rico and Argentina

Puerto Rico’s Science, Technology and Research Trust (PRSTRT) will...

-

15 May 2018

H.I.G. Capital Acquires Parque Ana Costa in São Paulo, Brazil

Global private equity firm H.I.G Capital has announced the acquisition of...

-

14 May 2018

Pegasus Exits Peruvian Fuel Importer Pure Biofuels Del Peru

U.S. private equity firm Pegasus Capital Advisors has sold its stake in...

-

7 May 2018

Inside Latin America's Breakout Year in Tech

Inside Latin America's Breakout Year in Tech is an 8-page graphic report...

-

7 May 2018

HCS Capital Partners Invests US$1m in Chilean Regulatory Tech Startup Ceptinel LLC

HCS Capital Partners completed a US$1m investment Ceptinel LLC, a Chilean...

-

23 April 2018

Brazil Tower Company Closes US$79m of Long-Term Debt Financing

Brazil-based independent tower company Brazil Tower Company (BTC) had a...

-

19 April 2018

ALLVP Makes Undisclosed Investment in Health-Tech Platform SocialDiabetes

ALLVP made an undisclosed investment in SocialDiabetes, a Barcelona-based...

-

19 April 2018

Bamboo Capital Partners Exit Peru's Microfinance Provider Mibanco

Bamboo Capital Partners has announced its exit from the Peruvian-based...

-

18 April 2018

Vostok Emerging Finance Contributes Additional US$5m to Series C in Brazilian Digital Lending Platform Creditas

Vostok Emerging Finance led a US$55m Series C investment in Creditas, with...

-

16 April 2018

Brookfield to Sell Majority Stake in Raposo Shopping (em português)

Brazil’s antitrust authority CADE has approved Brookfield’s sale of a...

-

13 April 2018

LLR Partners Leads US$31m Series C in Argentine Cypersecurity Startup Onapsis

LLR Partners led a US$31m Series C in Argentine cybersecurity startup...

-

9 April 2018

ACON's Citla Energy Wins Fourth Production-Sharing Contract in Mexico

Mexican independent exploration and production company Citla Energy, which...

-

5 April 2018

Patria Investments Acquires Chilean Gym Chain O2 (en español)

Brazilian-based alternative investment manager Patria Investments has...

-

4 April 2018

Advent Increases Stake in Brazilian Post-Secondary Education Company Estácio (em português)

Global private equity firm Advent International has increased its stake in...

-

4 April 2018

monashees+ and Grishin Robotics Lead US$9m Seed Round in Brazil Bike-Share Startup Yellow

monashees+ and Grishin Robotics led a US$9m seed investment in Yellow, a...

-

3 April 2018

Equity International & Goldman Sachs Merchant Banking Division Invest in Argentine Real Estate

Equity International, Goldman Sachs Merchant Banking Division, and...

-

2 April 2018

Ashmore Group Acquires Peruvian Mining Company STRACON

Emerging markets investment manager Ashmore Group and Steve Dixon, CEO and...

-

28 March 2018

Redpoint eventures and Others Invest US$16m in Pipefy (em português)

Trinity Ventures, Openview, Redpoint eventures, Funders Club, Valor...

-

26 March 2018

Goldman Sachs Merchant Banking Division Leads Investment in Brazil's Grupo Oncoclínicas (em português)

Goldman Sachs’ Merchant Banking Division led a growth equity investment...

-

15 March 2018

Mexico's Grupo Bimbo to Launch Impact Fund (en español)

Mexican multinational baking company Grupo Bimbo, in collaboration with...

-

12 March 2018

Exceed Capital Partners Leads Series B in Yogome

Exceed Capital Partners led a US$26.9m Series B investment in Yogome, a...

-

5 March 2018

CADE Approves CPPIB & Votorantim's Purchase of Ventos do Araripe Wind Complex

Brazil’s antitrust authority CADE has given approval to the Canadian...

-

3 March 2018

Canary Raises R$160m Fund (em português)

Canary raised R$160m for its first fund. Investments include fintech...

-

27 February 2018

Paladin Realty to Launch New Real Estate Projects in Latin America in 2018

Institutional real estate fund manager Paladin Realty Partners plans to...

-

27 February 2018

Credit Suisse Invests in Mexico's CMR (en español)

Credit Suisse Mexico, through a CKD vehicle, acquired a minority stake in...

-

26 February 2018

Global Investors in Latin American Startups

International appetite to invest in Latin American startups has grown...

-

19 February 2018

CONSAR Seeking to Increase Afores Investment Limits for Infrastructure (en español)

Mexico’s National Commission of Savings Systems for Retirement...

-

13 February 2018

Blackstone Names Jon Gray as President & Chief Operating Officer

Blackstone has announced that Tony James, President and Chief Operating...

-

1 February 2018

ResponsAbility Investments Exits Peru's Financiera Confianza

responsAbility Investments exited Financiera Confianza, a Peruvian...

-

30 January 2018

Summit Agricultural Group Invests US$100m in Brazil's FS Bioenergia

Summit Agricultural Group has made a US$100m investment in FS Bioenergia,...

-

30 January 2018

Temasek Invests in Brazilian Medical Clinic Network Clínica SIM (em português)

Temasek made an undisclosed investment in Clínica SIM, a private network...

-

29 January 2018

Nexxus Has First Close on Private Equity Fund after Raising €130m

Mexican private equity firm Nexxus Capital has held a first close on its...

-

24 January 2018

Chromo Invest & 42K Investimentos Invest R$15m in Brazil's BizCapital (em português)

Chromo Invest and 42K Investments made a R$15m investment in BizCapital, a...

-

22 January 2018

Rakuten & Other Investors Inject US$160m Series E into Cabify & Easy Parent Company

Rakuten Capital, TheVentureCity, Endeavor Catalyst, GAT Investments, Liil...

-

11 January 2018

State of the Industry: 2017 VC Deal Activity & Highlights

The entrance of major global investors into a string of recent early and...

-

19 December 2017

Credit Suisse Mexico Invests MXN$605m in Tech & Education (en español)

Credit Suisse Mexico made two separate investments totaling MXN$605m via...

-

18 December 2017

México Retail Properties Finalizes Sale of Commercial Real Estate to Fibra Uno (en español)

Mexican private real estate investor México Retail Properties (MRP) has...

-

13 December 2017

Macquarie to Buy Troy Energía's Stake in Mexican Hydroelectric Project (en español)

Macquarie Infrastructure Fund agreed to purchase Troy Energía’s 51%...

-

13 December 2017

Beamonte Investments to Invest MXN$1b in Axman Holdings

Family office Beamonte Investments has committed MXN$1b to Axman Holdings,...

-

11 December 2017

GP Investimentos Raising Fund to Buy Power Distribution Company (em português)

Private equity firm GP Investimentos is raising a US$300m fund to purchase...

-

8 December 2017

Village Capital Awards Mutuo Financiera and Fintual US$75k (en español)

Village Capital awarded US$75k to Mutuo Financiera, a startup offering...

-

23 November 2017

Colombian Government to Launch New Infrastructure Fund (en español)

Colombian development finance institution Financiera de Desarrollo...

-

22 November 2017

Devlabs Ventures Launches Chile Outlier Seed Fund I (en español)

DevLabs Ventures has launched the Chile Outlier Seed Fund I with a target...

-

21 November 2017

VBI Real Estate Launches Shed Business VBILog (em português)

Real Estate fund manager VBI Real Estate has launched VBILog, a...

-

17 November 2017

Australis Acquires Stake in Chile's Inmobilaria Pocuro (en español)

Australis Partners has acquired a stake in a Chilean residential...

-

14 November 2017

Domo Invest Bets on Brazil's Noverde (em portugués)

Domo Invest made an undisclosed investment in Noverde, an online lending...

-

8 November 2017

Goldman Sachs Leads US$20m Series C Investment in CargoX

Goldman Sachs led a US$20m Series C investment in Brazilian trucking...

-

1 November 2017

GPS Investimentos Launches Private Equity Fund (em português)

Brazilian wealth management company GPS Investimentos has partnered with...

-

1 November 2017

The Venture City Launches US$100m Global Fund for Startups

Miami-based The Venture City launched a US$100m venture fund to invest in...

-

19 October 2017

Intel Capital Leads US$8.5m Series A Round in EchoPixel

Intel Capital led a US$8.5m Series A investment in EchoPixel, a...

-

16 October 2017

IFM Acquires OHL Concesiones for €2.775b (en español)

Spanish construction company OHL has announced an agreement to sell its...

-

14 October 2017

Santander InnoVentures Leads US$6m Investment in Mexico's ePesos (en español)

Santander InnoVentures led a US$6m investment in Mexico’s ePesos, a...

-

5 October 2017

Grupo de Narváez and L Catterton Acquire Argentina's Caro Cuore (en español)

Grupo de Narváez and U.S. private equity firm L Catterton acquired Caro...

-

30 September 2017

Latin American Investors Make Series A Investment in Colombia's Autolab (en español)

A group of American, British, Colombian, Mexican, and Peruvian investors...

-

18 September 2017

Corporate Venture in Brazil Gains Steam as Giants Amp up Startup Investments

LAVCA’s 2017 Latin American Startup Directory shows that of the 144...

-

15 September 2017

Mesoamerica and Polymath Ventures Form Strategic Partnership

Private equity investor Mesoamerica and company builder Polymath Ventures...

-

21 August 2017

TriLinc Global Impact Fund Makes Investments in Latin America

TriLinc Global Impact Fund made a US$37.5m impact investment in term loan...

-

21 August 2017

Goodman Launches US$1b Brazilian Logistics Platform

Global logistics specialist Goodman has raised US$1bn (€852m) from...

-

14 August 2017

PGGM & APG Commit to GTIS' Latest Brazil Real Estate Fund

European investors PGGM and APG made significant capital commitments to...

-

28 June 2017

Angel Network Verus Group Invests in Hands

Angel network Verus Group made an undisclosed investment in Hands, a...

-

28 June 2017

Portland Caribbean Fund Invests US$8m in Melville's Diverze Assets

Portland Private Equity’s Portland Carribean Fund invested US$8m in...

-

26 June 2017

Victoria Acquires Controlling Stake in Oncólogos del Occidente

Victoria Capital Partners acquired a controlling stake in Oncólogos del...

-

21 June 2017

Proterra Brazil Closes US$100m Fund

Proterra Investment Partners held a US$100m first close for its debut...

-

20 June 2017

Lone Star Funds Acquires Brazilian Apoema Capital Partners (en español)

U.S. private equity firm Lone Star Funds has made its debut deal in Brazil...

-

9 June 2017

Ashmore Purchases 35.8% Stake in Colombian Road Project from Odinsa (en español)

The Ashmore Group completed the purchase of a 35.5% stake in the Colombian...

-

8 June 2017

Investors Continue to Show Interest in Brazilian Real Estate (em português)

Despite recent political developments, real estate investors continue to...

-

7 June 2017

Aqua Capital Acquires Majority Stake in Agro100 (em português)

Aqua Capital acquired a majority stake in Brazilian agriculture company...

-

5 June 2017

Syndicates Invest in Chile's Keteka, Faro.travel, Monitor & PlieQ (en español)

A group of investors co-invested seed capital in Latin American startups...

-

5 June 2017

Patria and Blackstone Buys Stake in Med Imagem (em português)

Patria Investimentos and Blackstone bought a 60% stake in Brazilian...

-

2 June 2017

Performa Investimentos Injects R$29.9m in UNICOBA Energia

Performa Invetmentos has invested R$29.9m in UNICOBA Energia, a LED...

-

19 April 2017

TRG Acquires Majority Stake in Eco Minera

The Rohatyn Group (TRG) acquired a majority stake in Argentine mining...

-

17 April 2017

Confrapar Invests in Muxi (em português)

Confrapar will invest up to R$16m in payments platform Muxi, which aims to...

-

6 April 2017

Ley de FinTech in the Works as FinTech Hurricane Hits Mexico (en español)

Mexico is in the process of passing Ley de FinTech to regulate the sector,...

-

4 April 2017

Cabify to Invest US$200m on Brazil Expansion (em português)

Cabify, the transportation app with a presence in 11 Latin American...

-

4 April 2017

L Catterton Asia Combines Newly Acquired Maaji with SEAFOLLY to Create Global Swimwear Business

L Catterton Asia acquired Colombian beachwear brand MAAJI and merged it...

-

4 April 2017

Castle Harlan's CRI Expands into Mexico with Firehouse Subs

Caribbean Restaurant Inc. (CRI), the Puerto Rican Burger King franchisee...

-

3 April 2017

Advent International's GTM Completes Acquisition Brazilian Chemical Distributor quantiQ

GTM Holdings, a portfolio company of private equity firm Advent...

-

3 April 2017

BlueOrange Launches Impact Fund to Invest US$1b in Latin America and the Caribbean

BlueOrange Capital launched an impact fund that plans to mobilize US$1b...

-

30 March 2017

Cuestamoras Exits Marriott with Sale to CPG Real Estate and Grupo Enjoy (en español)

CPG Real Estate and Enjoy Group acquired Marriott Los Sueños and Marriott...

-

30 March 2017

The Abraaj Group to Invest US$1.5b in Mexico and Latin America (en español)

Dubai-based The Abraaj Group announced it plans to invest up to US$1.5b in...

-

27 March 2017

AMEXCAP Lobbies Mexican Government to Create LP Fund Structure (en español)

AMEXCAP is lobbying the government to introduce the Limited Partnership as...

-

23 March 2017

Brazil's Congress Approves Outsourcing (em português)

The Brazilian congress approved Projeto de Lei, a new law that allows...

-

17 March 2017

Blackstone Acquire the Windsor Atlantica Hotel

Blackstone announced that funds managed by its real estate business have...

-

16 March 2017

Advent International's Nyx Participações to Acquire Easynvest

Advent International-controlled Nyx Participações S.A. signed an...

-

15 March 2017

NXTP Labs Bets on AgTech and Invests in Kilimo (en español)

NXTP Labs made an undisclosed investment in Kilimo, an Argentinian AgTech...

-

13 March 2017

Paladin Realty Partners Sees Opportunities in Peru and Brazil (en español)

Positive economic outlooks for Peru and Brazil have buoyed the spirits of...

-

3 March 2017

IFC Invests US$100m in Orazul Energy to Diversify Latin America’s Energy Mix and Support Clean Energy

The IFC and IFC Global Infrastructure Fund invested US$100m in Orazul...

-

27 February 2017

AES Tietê Agrees to Acquire Wind Farms from Brazil's Renova Energia (en español)

Brazilian renewable energy company Renova Energia, an Angra Partners...

-

21 February 2017

L Catterton Partners with Grupo de Narváez to Expand Argentina's Rapsodia in the Region (en español)

L Catterton partnered with Grupo de Narváez to make its debut investment...

-

20 February 2017

IFC Leads R$60m Series B in Creditas (formerly BankFacil) (em português)

The International Finance Corporation (IFC) led a R$60m Series B...

-

17 February 2017

Y Combinator Invests in Colombian Home and Office Services Startup Hogaru (en español)

Y combinator invested US$120k in Hogaru, a Colombian home and office...

-

15 February 2017

Carlos Kokron of Qualcomm Ventures: "Emprender es una maratón sin espacio para éxitos fáciles o rápidos" (en español)

Carlos Kokron of Qualcomm Ventures highlights the importance of...

-

2 February 2017

Jaguar's Aliansce Increases Stake in Two Brazilian Shopping Malls (em português)

Jaguar Growth Partners’ portfolio company, Aliansce, reached an...

-

1 February 2017

AC Capitales Exits Redesur (en español)

Red Eléctrica has purchased 45% of Peruvian electricity transmission...

-

23 January 2017

Advent International's GTM Acquires Brazilian quantiQ for R$550m

GTM, a Latin American chemical distributor and portfolio company of Advent...

-

22 January 2017

Monashees+ Invests R$1m in Cambly (em português)

Venture Capital firm Monashees+ invested R$1m in English learning app...

-

17 January 2017

Alta Growth Capital Invests in +KOTA

Alta Growth Capital announced an investment in Mexican pet retailer...

-

16 January 2017

Abraaj Acquires Majority Stake in Chilean Firm Casaideas

The Abraaj Group has acquired a majority stake in Casaideas, a home design...

-

10 January 2017

500 Startups to Invest More than US$1m in New Latin American Startups (en español)

500 Startups has opened the seventh batch of its seed program in Mexico...

-

9 January 2017

Jaguar Growth Holds Final Close on First Real Estate Fund

New York-based investment management firm, Jaguar Growth Partners,...

-

9 January 2017

Actis and Mesoamerica Exit Globeleq Mesoamerica Energy (en español)

(Press Release) Actis and Mesoamerica announced the sale of their stake in...

-

9 January 2017

Cade Approves Gávea's Purchase of Stake in Natural One (em português)

The Brazilian Administrative Council of Economic Defense (Cade) approved,...

-

3 January 2017

ACON Invests in Mexico's GMI

(PR Newswire) ACON Investments announced that affiliates of ACON Latin...

-

30 December 2016

Carlyle Acquires 75% Stake in Chile's Gastronomía & Negocios

(Press Release) The Carlyle Group acquired a 75% stake Gastronomía &...

-

19 December 2016

Southern Cross Group to Invest in Telecom and Technology (en español)

(Expansión) Private equity firm Southern Cross Group will invest 30% of...

-

19 December 2016

Walton Street México to Invest MXN1.4b in Real Estate Projects (en español)

Mexican private equity firm Walton Street México will invest MXN1.4b in...

-

7 December 2016

EMX Capital Invests in Orben Communications (en español)

(AMEXCAP) EMX Capital, a Mexican private equity firm, has made a...

-

27 November 2016

Intralot Group Sells 80% Stake in Peruvian Operations to Nexus Group

(PGRI Public Gaming) Greek gaming solutions supplier Intralot Group...

-

18 November 2016

500 Startups Invests R$500k in Idwall (em português)

(ITForum 365) 500 Startups has invested in Brazilian startup Idwall, an...

-

14 November 2016

Southern Cross to Issue First CKD (en español)

(El Economista) Southern Cross, a private equity firm with a presence in...

-

21 October 2016

Southern Cross to Buy a 55% Stake in Masvida for US$90m (en español)

(Diario Financiero) Southern Cross has reached an agreement to purchase a...

-

17 October 2016

Movile's Maplink Acquires Optilogistic

(Tech.eu) Optilogistic, a French logistics software company, has been...

-

17 October 2016

Activa, LarrainVial's PE Investment Arm, Acquires FenVentures (en español)

(El Mercurio) Activa, the private equity investment arm of LarrainVial,...

-

17 October 2016

A Look into Chile’s Innovative Startup Government

(TechCrunch) The rise of “Chilecon Valley” — as the nascent startup...

-

10 October 2016

I Squared Capital Acquires Duke Energy International's Latin American Businesses for US$1.2b

(Business Wire) I Squared Capital will purchase 100% of Duke Energy...

-

5 October 2016

Advent International's GTM Acquires Peruvian Peruquímicos

(Press Release) GTM, a Latin American chemical distributor and portfolio...

-

30 September 2016

L Catterton Buys 52% of St. Marche and Eataly for R$226m (em português)

(Valor Econômico) American private equity firm, L Catterton, has bought a...

-

28 September 2016

Environmental Decontamination Startup Receives R$3m (em português)

(Exame) OXI Ambiental, a Brazilian startup that decontaminates areas...

-

28 September 2016

Why Have Some of Silicon Valley’s Top Investors Started Investing in Latin America?

LAVCA Director of Venture Strategy, Julie Ruvolo, lays out the venture...

-

28 September 2016

Macquaire's Mexico Infrastructure Fund Announces Follow-on Investments (en español)

(Press Release) Macquaire’s Mexico Infrastructure Fund has made...

-

20 September 2016

ALLVP Invests in Dentalia, Mexican Dental Clinic Network Dentalia

(Press Release) ALLVP led a MX$100m Series B in dental clinic network...

-

18 August 2016

Southern Cross Acquires Stake in Grupo Intellego (en español)

(Expansión) Latin American private equity fund, Southern Cross, has...

-

12 August 2016

Advent International's Gotemburgo Participaçõesto Acquires Fortbras Group

(Press Release) Gotemburgo Participações, a holding company controlled...

-

28 July 2016

Carlyle to Exit CVC (em português)

(Valor Econômico) The Carlyle Group will reduce its stake in Brazilian...

-

27 July 2016

Andreessen Horowitz, Sequoia, DST Global Invest in Colombian App Rappi (en español)

Andreessen Horowitz invested an undisclosed amount in Rappi, a Colombian...

-

25 July 2016

Petrobras Chile Sold for US$464m to Private Equity Firm

(PetroPlaza) Petrobras has signed an agreement to sell 100% of Petrobras...

-

22 July 2016

Elevar Equity Exits Caja Rural Los Andes

(Press Release) Elevar Equity, a human centered venture capital firm, has...

-

22 July 2016

Kandeo Acquires Peruvian Car Finance Lender Acceso Crediticio for US$51m

(Latin Lawyer) Colombian private equity fund Kandeo has invested in Peru...

-

23 June 2016

NCF Consultores Sells 8.51% Stake in Diviso Grupo Financiero to Maj Invest

(Reuters)Consultores transferred its entire stake of 8.51% in Diviso Grupo...

-

17 June 2016

Venture Capital Acts as Driving Economic Growth Force in Latin America Study Shows

(FOMIN) Over the last 20 years the Multilateral Investment Fund, along...

-

14 June 2016

e.Bricks Ventures to Invest R$300m in Startups (em português)

(Valor Econômico) e.Bricks Ventures is targeting R$300m for its second...

-

13 June 2016

Ipiranga Acquires Darby's Alesat Combustíveis (em português)

(Valor Econômico) Brazilian fuel distribution company Alesat...

-

9 June 2016

CPPIB and OTPP to Invest US$1.35b in Mexico City Infrastructure

(570 News) Two of Canada’s biggest pension fund managers, CPPIB and...

-

28 April 2016

Advent International Appoints Enrique Pani as Mexico City Managing Director

(Press Release) Advent International, one of the largest and most...

-

25 April 2016

Advent International Acquires Mexico's Viakem

(Press Release) Advent has agreed to acquire VIAKEM, a Mexican...

-

15 April 2016

Brazil's BRF Acquires Eclipse's Campo Austral for US$85m (em português)

-

13 April 2016

Patria's P2 Brasil to Investment R$405m in Brazil Power Infrastructure (em português)

(Portal Brasil) P2Brasil, Patria Investimentos’ private equity...

-

29 March 2016

Summit Agricultural Group Leads US$115m Investment in F&S Agri Solutions

(Press Release) US-based Summit Agricultural Group has made a US$115m...

-

22 March 2016

Advent International Raises US$13b (€12 billion) Global Private Equity Fund

(Press Release) Global private equity firm Advent International exceeded...

-

16 March 2016

Aker Security Solutions Closes New Investment Round from Invest Tech (em português)

(Baguete) After two financing rounds that included 15 investors, Alkanza...

-

9 March 2016

Workana Receives Investment of R$8m (em português)

(Baguete) Workana, an online marketplace focused on contracting...

-

4 March 2016

L Catterton Invests in Latin American Gym Chain Bodytech

(PeHub) L Catterton made a growth capital investment in Bogota,...

-

29 February 2016

The Carlyle Group & Vinci Partners Jointly Acquire Brazilian Education Company Uniasselvi

(Press Release) The Carlyle Group and Vinci Partners have jointly acquired...

-

6 February 2016

DLM's Cipher Acquires BRConnection (em português)

(Press Release) DLM private equity’s CIPHER, a cybersecurity...

-

4 February 2016

General Atlantic Increases Stake in Brazil's XP Investimentos (em português)

(Valor Econômico) General Atlantic increased its stake in XP...

-

14 January 2016

Oikocredit Invests in Nicaragua's Nicafrance

(Press Release) Oikocredit closed 2015 with an important investment in...

-

7 January 2016

Founders Fund Leads a Financing Round for Nubank, a Brazilian Start-Up

(DealBook) Brazilian start-up Nubank, a mobile-based credit card business,...

-

30 December 2015

Actis Exits Guatemalan Energy Provider Energuate

(PRNewswire) Actis has reached an agreement to sell Guatemalan electricity...

-

22 December 2015

GPF Capital Buys Acuntia from Corpfin Capital

(Press Release) GPF Capital has made its second investment for 2015...

-

21 December 2015

General Atlantic Buys 17% Stake in Brazil Retailer Pague Menos

(Reuters) Empreendimentos Pague Menos SA, Brazil’s No. 3 drugstore...

-

15 December 2015

Capital Group Sells Stake in Grupo Ibmec Educacional

(Estadão E&N) Marking the largest acquisition in the country, DeVry...

-

24 November 2015

Alothon Group Confirms Investment in Brazil’s Grupo MPR

(Business Wire) Alothon Group LLC, a leading middle market private equity...

-

23 November 2015

Omnicom Group's DDB Worldwide Acquires Grupo ABC, Giving Kinea Investments a Full Exit

(PR Newswire) DDB Worldwide, a division of Omnicom Group Inc., announced...

-

19 November 2015

Lemann in Negotiates Million Dollar Investment in Movile

(Exame) Brazilian mobile content business, Movile, is in negotiations with...

-

17 November 2015

George Soros Puts Money on Latin America Hotels

(WSJ) Billionaire George Soros’s investment firm has agreed to spend up...

-

14 November 2015

Nexus Sold 9.94% Stake in Cineplanet (en español)

(El Comercio) Peru’s Nexus Group has sold a 9.94% stake in Cineplex,...

-

9 November 2015

The Carlyle Group Acquires Controlling Stake in Tempo Participações

(Press Release) Global alternative asset manager The Carlyle Group...

-

3 November 2015

Victoria Capital & IFC's Ideal Inveset Cashes in on Brazilian Students' Loans

(Financial Times) A deep recession might not be the most advantageous...

-

13 October 2015

Nexxus Capital Announces the Formation of the Portfolio Operations Team

(Press Release) Nexxus Capital announced the creation of The Portfolio...

-

30 September 2015

The MIF Approves US$1.2m Project with Alta-El Dorado Emprendimien to Stimulate Peru's Entrepreneurial Ecosystem

(Press Release) The Multilateral Investment Fund (MIF), a member of the...

-

19 September 2015

Nexxus III Fully Divests from Olab

(Press Release) Nexxus Capital announces that through Nexxus Capital...

-

16 September 2015

Physician Group to Sell Minority Stake in Fleury S.A. to Advent International

(Press Release) A physician group that owns a significant interest in...

-

26 August 2015

El Paso Fire & Police Pension Funds Commits to Southern Cross

(Pensions & Investments) El Paso (Texas) Firemen & Policemen...

-

24 August 2015

Loggi Receives Investment of R$50m (em português)

(Fusões & Aquisições) Loggi, the online express delivery services,...

-

20 August 2015

GuiaBolso Raises US$7m to Extend Its Leadership in Brazil’s Personal Finance Market

(Businesswire) GuiaBolso is changing the way Brazilians manage their...

-

18 August 2015

Chile's DesRueda.com Raises US$130k to Expand Services to Latin America (en español)

(Pulso Social) Chilean startup DesRueda.com, an online platform that...

-

13 August 2015

The Abraaj Group Invests in Latin American Courier and Light Logistics Company URBANO

(Press Release) The Abraaj Group announced the acquisition of a majority...

-

3 August 2015

Venezuela-Focused Fund to Launch Later This Year

(Bloomberg) Thomas Samuelson, a founder of Miami-based INCA Investments,...

-

16 June 2015